Slim overseas pickings for mainland oil firms

Karen Teo

January 8, 2005

If China National Offshore Oil Corp (CNOOC) makes a bid for Unocal Corp, a second-tier United States energy company, it will underscore just how hungry China's oil majors are for overseas production assets - and just how few of them are on the table.

``There is just not much out there to buy,'' said a US-based Chinese industry source.

CNOOC and its larger rivals, China National Petroleum Corp and Sinopec, are on the prowl for oil and natural gas reserves just about anywhere they can find them.

Yet much of the world's current and future production is already locked up either by international majors too big to swallow such as Exxon-Mobil, or state-owned companies such as Saudi Aramco and Kuwait Petroleum that will never sell.

That leaves the smaller players, and thanks to the industry consolidation of the past two decades, there are not many around - and the best ones were taken years ago.

Enter Unocal, the former Union Oil Co of California, which was never much more than a bit player in the US oil business but has a grab-bag of Asian production assets that has caught CNOOC's eye.

The Financial Times on Friday reported that CNOOC is considering offering more than US$13 billion (HK$101.4 billion) for the outfit, which would be partly financed by selling the company's US assets. Xiao Zongwei, director of investor relations at CNOOC, declined to comment on the report. An acquisition would give CNOOC, the dominant Chinese offshore producer, a collection of production assets scattered across the region, including reserves in Bangladesh, Thailand, Burma, Azerbaijan and Indonesia.

Though significant, these reserves are not much by international standards and its current production would not go far to meet China's rapidly-growing oil needs.

Unocal's net proved reserves including crude oil, condensate and natural gas liquids have fallen steadily over the past three years to 675 million barrels last year from 693 million barrels in 2001, says the company.

Production has been dwindling, too. It sank to 160,000 barrels a day in 2003 from to 170,000 in 2001. In Thailand, home to Unocal's biggest Asian reserves, daily production is a modest 20,000 barrels per day, though the company plans to double that by 2006.

Still, that is better than nothing, and despite an increasingly aggressive search, China's oil firms thus far have not had much success in landing major new sources of supply.

In CNOOC's case, its major invest-ments are in the Northwest Shelf venture in Australia and some Indonesian production, along with a recent foray into Burma.

There has also been speculation that CNOOC wants to buy Royal Dutch/Shell's stake in Australia's Woodside Petroleum.

That could boost CNOOC's production by 14 percent over its projected 2004 output of 140 to 145 million barrels of oil equivalent.

Currently, CNOOC's production is mostly offshore China, and the International Energy Agency reckons the mainland can rely heavily on those areas for the next five years. Yet recent discoveries there have proved disappointing, a key reason China's oil production is stagnating. Mainland output will average 3.52 million barrels per day this year, up only 1.7 percent or 60,000 barrels per day from 3.46 million in 2004, with two-thirds of that increase coming from offshore fields.

CNOOC's total net proved reserves, which include fields in the Bohai Bay, East China Sea and other offshore areas, edged up 5.5 percent to 2.1 billion barrels of oil equivalent in 2003.

|

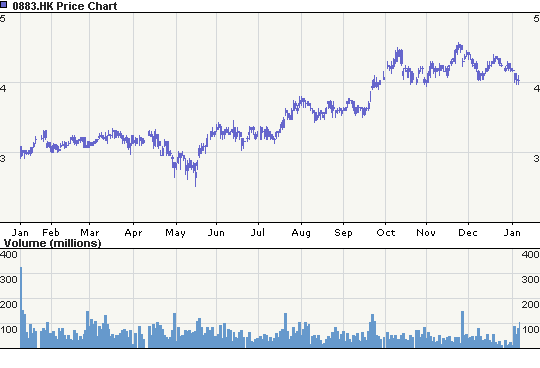

Angehängte Grafik:

chart_index.png (verkleinert auf 94%)