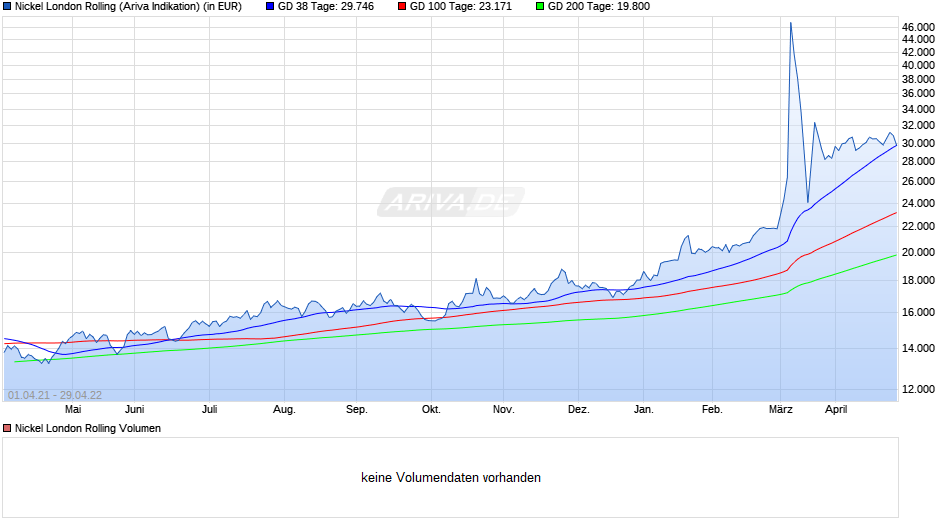

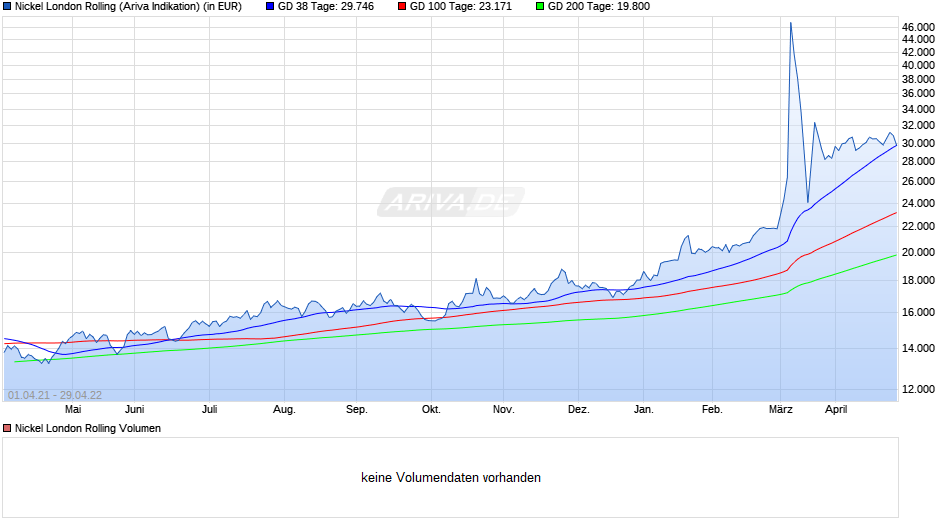

Interessant ist das man mit einen Tonnenpreis von 22 500 Nickel kalkuliert hatte und der jetzige Marktpreis über 44 000 Australischen Dollar ist.

Nickelpreis heute in Dollar: 31.691,91 $

Niemand weiß wie sich der Nickelpreis in Zukunft entwickelt, aber die Finanzdaten bei

https://de.marketscreener.com/kurs/aktie/...S-NL-443696/fundamentals/

bedürfen der Überarbeitung.

https://www.mincor.com.au/site/PDF/...inunderenhancedofftakeagreement

ABNAHMEVEREINBARUNG GESCHLOSSEN

BHP Nickel West und Mincor einigen sich auf Änderungen des bestehenden Abnahmevertrags, die sich daraus ergeben

wobei die erste Produktion für Mai 2022 festgelegt ist und der erste Cashflow im Juni 2022

• Zukünftige Verkäufe basieren auf unterstelltem Nickel in der Konzentrat- (und Nebenprodukt-)Produktion durch die

Implementierung einer Gehaltsgewinnungskurve, die auf das an Kambalda Nickel gelieferte Nickelerz angewendet wird

Konzentrator („NKC“)

• Die Graderholungskurve und die daraus resultierende imputierte Konzentratproduktion spiegeln die Annahmen des wider

März 2020 Endgültige Machbarkeitsstudie („DFS“)

• Erz, das bis zum 31. Mai 2022 an NKC geliefert wird, wird in eine imputierte Konzentratproduktion umgewandelt, was daraus resultiert

im ersten Cashflow aus Konzentratverkäufen, die von Mincor im Juni 2022 generiert wurden

• Der aktuelle Nickel-Spotpreis von ca. 46.000 AUD/t übersteigt die DFS-Annahme von 22.500 AUD/t deutlich

Top 20 Shareholders

as at 22 April 2022

Rank Name Units % Units

1HSBC CUSTODY NOMINEES (AUSTRALIA) LIMITED 100,364,733 20.72%

2CITICORP NOMINEES PTY LIMITED 51,312,556 10.59%

3IGO LIMITED 34,861,667 7.20%

4J P MORGAN NOMINEES AUSTRALIA PTY LIMITED 25,181,855 5.20%

5NATIONAL NOMINEES LIMITED 14,083,415 2.91%

6HISHENK PTY LTD 6,400,000 1.32%

7UBS NOMINEES PTY LTD 4,340,921 0.90%

8HILLBOI NOMINEES PTY LTD 4,070,000 0.84%

9WILLOUGHBY CAPITAL PTY LTD 3,700,000 0.76%

10NEWECONOMY COM AU NOMINEES PTY LIMITED <900 ACCOUNT> 3,573,147 0.74%

11BNP PARIBAS NOMINEES PTY LTD ACF CLEARSTREAM 3,417,594 0.71%

12SPAR NOMINEES PTY LTD 3,261,938 0.67%

13ROSS SUTHERLAND PROPERTIES PTY LTD 3,193,164 0.66%

14BOND STREET CUSTODIANS LIMITED 3,004,473 0.62%

15MR DAVID CHARLES MOORE 3,000,000 0.62%

16BNP PARIBAS NOMINEES PTY LTD SIX SIS LTD 2,379,216 0.49%

17BNP PARIBAS NOMINEES PTY LTD 2,359,287 0.49%

18MR ANTHONY HUBERT SHIELDS 2,100,000 0.43%

19BRAZIL FARMING PTY LTD 1,916,667 0.40%

20BNP PARIBAS NOMINEES PTY LTD HUB24 CUSTODIAL SERV LTD 1,816,618 0.38%

Total274,337,251 56.64%§

|

Thread abonnieren

Thread abonnieren