Lithium, vielleicht der diesjährige Rohstofftrend

|

Seite 1 von 3

neuester Beitrag: 25.04.21 00:32

|

||||

| eröffnet am: | 24.11.10 20:15 von: | siggileder | Anzahl Beiträge: | 68 |

| neuester Beitrag: | 25.04.21 00:32 von: | Utanqaqa | Leser gesamt: | 25719 |

| davon Heute: | 6 | |||

| bewertet mit 3 Sternen |

||||

|

2 |

3

|

2 |

3

|

||||

|

--button_text--

interessant

|

|

witzig

|

|

gut analysiert

|

|

informativ

|

3

TALISON LITHIUM REPORTS FINANCIAL

RESULTS FOR THE 2011 FIRST QUARTER

ENDED SEPTEMBER 30, 2010

NEWS RELEASE

Perth, Western Australia, November 15, 2010 – Talison Lithium Limited (“Talison”)

(TSX:TLH) announces financial results for the 2011 first quarter(1) ended September 30, 2010

(“First Quarter”).

Peter Oliver, CEO and Managing Director said, “The First Quarter represented the achievement

of a significant milestone for Talison as it acquired the Greenbushes Lithium Operations from its

predecessor, became a public company and listed on the Toronto Stock Exchange, completed

the acquisition of Salares Lithium Inc. and raised C$40 million in a private placement, and

importantly, recorded record lithium concentrate production for the First Quarter at its

Greenbushes Lithium Operations.”

Highlights

• Talison completed its reorganisation, the acquisition of Salares Lithium Inc., a C$40

million private placement and listed on the Toronto Stock Exchange

• Lithium concentrate production of 80,729 tonnes (approximately 12,000 tonnes lithium

carbonate equivalent (“LCE”)), representing a 24% increase over the same prior year

period

• Lithium concentrate sales of 52,524 tonnes (approximately 7,800 tonnes LCE),

representing a 6% increase over the over the same prior year period

• Demand for Talison’s technical-grade and chemical-grade lithium concentrate continues

to outstrip current production capacity, and Talison is selling 100% of its production

• The Stage 1 expansion of chemical-grade lithium concentrate production capacity at

Greenbushes Lithium Operations by 50,000 tonnes (approximately 7,500 tonnes LCE )

remained on schedule for completion early in calendar 2011

• Combined sales revenue for three months ended September 30, 2010 of A$21.1 million,

an increase of 24% over the three months ended September 30, 2009(1)

• Combined EBITDA for the three months ended September 30, 2010 of A$4.8 million.

Excluding A$1.6 million of non-recurring costs, EBITDA would show a 25% increase

over the three-month period ended September 30, 2009(2)

• Annual production of lithium concentrate for the financial year ending June 30, 2011 is

expected to exceed 43,000 tonnes LCE

• Approval of a A$1.9 million drilling program at the Greenbushes Lithium Operations with

the aim of significantly increasing lithium mineral reserves and resources

Subsequent to the end of the interim period, Talison refinanced its senior finance facility on

more favourable terms with the Commonwealth Bank of Australia.

Optionen

| Antwort einfügen |

| Boardmail an "siggileder" |

|

Wertpapier:

Talison Lithium

|

Angehängte Grafik:

imagegen.jpg

imagegen.jpg

0

Gibt es einen Lithium - Börsenkurs und wo kann man den finden.

Viel Glück an allem mit diesem Invest.

Optionen

| Antwort einfügen |

| Boardmail an "Basso6" |

|

Wertpapier:

Talison Lithium

|

1

Gibt hier sehr geteilte Meinungen.

Hoffe hiermit kannst du etwas anfangen. Grüße

http://www.faz.net/s/...67B8F4F939FB689028~ATpl~Ecommon~Scontent.html

Optionen

| Antwort einfügen |

| Boardmail an "YoHannes86" |

|

Wertpapier:

Talison Lithium

|

0

Naja erstmal dabeibleiben, auch wenn durch den Artikel die Stimmung etwas getrübt ist.

Optionen

| Antwort einfügen |

| Boardmail an "Basso6" |

|

Wertpapier:

Talison Lithium

|

1

http://boersenradar.t-online.de/Aktuell/Rohstoffe/...ka-20005436.html

Trotzdem ist es an den Märkten so, wenn die Nachfrage steigt, steigt der Preis meistens mit. (Siehe andere Mettalle). Es gibt auf diesen Planet sicherlich noch reichlich Vorkommen an Lithium. Selbst in Sachsen möchte die Solarworld möglicherweise eine eigene Mine betreiben ( siehe News Solarworld).

Optionen

| Antwort einfügen |

| Boardmail an "siggileder" |

|

Wertpapier:

Talison Lithium

|

1

Zu den Artikel die angeboten werden, einer von 2009 der andere von 2010 ?

Im Börsenleben ist schon ein Tag, Schnee von gestern.

Ich habe das Invest aufgrund des Artikels vom A....... gekauft, bisher hatte ich bei der Autorin eigentlich fast immer eine gute Hand.

Abwarten !!

Optionen

| Antwort einfügen |

| Boardmail an "Basso6" |

|

Wertpapier:

Talison Lithium

|

1

Ansonsten bleib ich etwas länger bei Talison investiert. Die Volatilen Kurse sind ja für Rostoffaktien nichts außergewöhnliches. Mit einer Uranium Energy war ich Anfangs auch 50% im Minus und anschließend wieder über 100% im plus.

Optionen

| Antwort einfügen |

| Boardmail an "siggileder" |

|

Wertpapier:

Talison Lithium

|

1

Talison ist der größte reine Lithiumproduzent

China möchte ganz weg vom Erdöl und steckt immer mehr in die Förderung von E-Fortbewegungsmittel und Batterien.

Talison besitzt in Australien Lithiumvorkommen, welche vom Reinheitsgrad höher sind (es wird auch von „Battery Grade“ gesprochen) als in anderen Ländern und Regionen der Erde und liefert z.Z. rund 80% der geförderten Menge alleine nach China, die dort zur Batterieproduktion verwendet werden und ist dort Hauptlieferrant.

Die Globale Produktion und Nachfrage ist steigend,die sich in den nächsten vorhersehbaren Jahren verdrei oder vierfachen sollen!

Talison baut deshalb seine Kapazitäten aus und die Expansion in Greenbushes schreitet voran, weil die Fördermengen schon jetzt zu wenig sind um den Markt zu bedienen.

Einige Stimmen zu Talison http://www.theenergyreport.com/pub/co/2142

Branson Hamilton, Seeking Alpha (12/06/10)

"Recently, there is evidence of tightening of lithium supplies. For example, Talison Lithium stated in its Nov 15 earnings announcement that demand for its technical- and chemical-grade concentrate is outstripping current production capacity. Traditional rock producers, including Talison Lithium, are expanding lithium carbonate production to reach the battery market."

Chris Berry, Morning Notes (11/22/10)

"In the Mature discovery space Talison Lithium is our favorite. Talison hosts a very high-grade deposit (4%) at its Greenbushes deposit in Western Australia. . .we think Talison has the potential to double or more over the next year. The company supplies 75% of China's lithium demand and China is moving aggressively ahead on its alternative energy future. This in itself is a significant reason to consider the company. Talison's production, sales and profitability are increasing significantly. . .this Mature Discovery stock is consolidating, and we expect a breakout from here. We have owned shares in Talison as a result of the reverse merger of Talison into Salares Lithium in July of this year. We believe the lithium space will be a rewarding place in which to seek discovery in the coming months for Discovery investors in both the Incubator and Mature categories."

Michael Berry, Morning Notes (11/15/10)

"Today, the lithium market is essentially controlled by four major companies—one of which is Talison Lithium. We met with the management of Talison in New York several weeks ago and came away duly impressed. TLH has a very large deposit in Western Australia that is also very high-grade, running up to 4% lithium. Talison supplies 75% of China's lithium requirements. . .TLH is the largest producer of lithium in the world and the grades of its deposit at Greenbushes are the highest grades. The recent takeover and reverse merger into Salares Lithium also provides it with a significant source of Chilean brine supply. . .At present, the stock is a value proposition even though it has appreciated 65% since its recent late September listing. We like the management. We think entry to the lithium concentrate marketplace is going to be expensive for new entrants, and we think lithium demand will outstrip supply over the next decade by an order of magnitude. Please have a look at Talison; it rates highly on our 10-point Discovery grid. We are shareholders in Talison from the reverse merger with Salares Lithium. We reserve the right to purchase additional Talison."

Thom Calandra, Stockhouse (11/15/10)

"The Talison Lithium story is well known. The stock has catapulted since August, when the Australia producer of lithium carbonate equivalents separated from mother ship Salares. In several days, at month's end, the successful Global X Lithium Fund will look at the structuring of its index, and then start adding Talison shares to the fund.Talison held a short conference call for its current results today (Monday). The call was its first as a separate company. Production from its Greenbushes project in Australia will exceed 43,000 metric tons of LCE for the fiscal year that closes June 2011. CEO Peter Oliver today gave a concise overview of the lithium market. The point with Talison is that it is a pure-lithium producer with high-concentrate, -quality and an improving chemical process."

Dave Brown, Resource Investing News (11/10/10)

"Talison Lithium mines and processes lithium-bearing mineral spodumene at Greenbushes near Perth, Western Australia. The company produces a range of lithium concentrates that are distributed to a well-established global customer base, including China. In July, a binding letter agreement was executed to combine Talison with Salares Lithium Inc. in order to strategically merge their respective lithium assets. Last month, Talison released unaudited year-end results for its Greenbushes lithium mine in Western Australia. The highlights included a 33% increase over the previous year's production of lithium concentrate as of June 30 with sales also increasing over the previous year by approximately 19%."

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

Lithium

auch bezeichnet als:

Lithiumazetat; Lithiumkarbonat; Lithiumsalze

Allgemeines

Lithium wird bei psychischen Erkrankungen, vor allem bei Störungen der Gefühlslage, eingesetzt. Hierzu gehört die Anwendung bei der sogenannten Manie, einer krankhaft gehobenen Stimmung oder die vorbeugende Behandlung von starken Stimmungsschwankungen (manisch-depressive Psychosen). Auch Patienten mit bestimmten akuten Depressionen können Lithium bei einer Unverträglichkeit gegen andere Antidepressiva einnehmen.

Aber ich bin sehr zuversichtlich,dass die Aktie in der Zukunft gut laufen wird .....und keiner von uns es als Medizin benötigen muß ;-)

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

http://www.lithiumsite.com/Lithium_Market.html

http://tyler.blogware.com/lithium_shortage.pdf

http://www.diplom.de/Diplomarbeit-14748/...ogien_im_Automobilbau.html

http://www.be24.at/blog/entry/644729/...oe%C3%9Fter-lithium-produzent

http://rohstoffe.gevestor.de/...larworld-einen-zweiten-fruehling.html

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

Talison Lithium Reports Record Sales and Production Results for Second Quarter 2011

Jan, 12, 2011 06:00 AM - Marketwire (Canada)

PERTH, WESTERN AUSTRALIA--(Marketwire - Jan. 12, 2011) - Talison Lithium Limited ("Talison") (TSX:TLH) announces its preliminary production results for the three and six months ended December 31, 2010 from its Greenbushes lithium operations in Western Australia (the "Greenbushes Lithium Operations"). For the six months ended December 31, 2010, production increased 32%, and sales increased 33% over the six months ended December 31, 2009.

Greenbushes Lithium Operations - Second Quarter 2011 Financial Year Production Results

Record production and sales were achieved from the Greenbushes Lithium Operations during the second quarter 2011 as a result of continued strong demand from customers, a successful ongoing production process improvement program and the early commissioning of the Stage 1 expansion. Talison continues to produce at capacity and sell 100% of its production.

Talison expects further improved production for the third quarter of the 2011 financial year, as a result of the completion of the Stage 1 expansion of the Greenbushes Lithium Operations in December 2010.

Key Operating Statistics

Financial Year ended

June 30, 2011(1)

--------------------------------------------------

Three Months Three Months Six Months

Ended September Ended December Ended December

30, 2010 31, 2010 31, 2010

--------------------------------------------------

Production(i) 80,729 83,548 164,277

--------------------------------------------------

Sales(i) 52,525 97,559 150,084

--------------------------------------------------

Financial Year ended

June 30, 2010

--------------------------------------------------

Three Months Three Months Six Months

Ended September Ended December Ended December

30, 2009 31, 2009 31, 2009

--------------------------------------------------

Production(i) 64,950 59,782 124,732

--------------------------------------------------

Sales(i) 49,386 63,309 112,695

--------------------------------------------------

Percentage Change

Financial Year ended June 30, 2011

to Financial Year ended June 30, 2010

--------------------------------------------------

Three Months Three Months Six Months

Ended September Ended December Ended December

30 31 31

--------------------------------------------------

Production(i) 24% 40% 32%

--------------------------------------------------

Sales(i) 6% 54% 33%

--------------------------------------------------

(i) Tonnes of lithium concentrate

Sales of lithium concentrate from the Greenbushes Lithium Operations in the second quarter 2011 increased substantially from 2010, with 97,559 tonnes of lithium concentrate (approximately 14,500 tonnes of lithium carbonate equivalent) sold, representing a 54% increase over the second quarter of 2010.

Sales for the first half of 2011 were 150,084 tonnes of lithium concentrate (approximately 22,200 tonnes of lithium carbonate equivalent), representing a 33% increase over the first half of 2010.

Production during the second quarter 2011 increased 40% over the second quarter 2010 to 83,558 tonnes of lithium concentrate (approximately 12,400 tonnes of lithium carbonate equivalent).

Production for the first half of 2011 was 164,277 tonnes of lithium concentrate (approximately 24,300 tonnes of lithium carbonate equivalent), representing a 32% increase over the first half of 2010.

Differences between production and sales of lithium concentrate for the first and second quarters are as a result of timing differences between production schedules and shipment schedules.

In addition to record second quarter production of lithium concentrate, the Greenbushes Lithium Operations also produced and sold a parcel of 12,206 tonnes of crushed ore. The sale of crushed ore to a key customer was a short term measure to meet market demand until Talison completed the Stage 1 expansion of the Greenbushes Lithium Operations. As this expansion has now been completed, Talison does not anticipate selling any further parcels of crushed ore.

Expansion of the Greenbushes Lithium Operations

Commissioning of the Stage 1 expansion of the Greenbushes Lithium Operations has now been completed.

Talison is continuing to plan the Stage 2 expansion. Detailed design work is progressing and to ensure that Talison is able to proceed with the expansion in calendar 2011 as originally planned, long lead time items have been ordered.

Salares 7 Project

Preparatory works are being undertaken for the commencement of drilling at the Salares 7 Project in Chile. Access roads to drill sites are being constructed, and sampling protocols and procedures have been developed. The Salares 7 camp is now fully operational and the first drilling program is expected to commence in early February 2011.

Refinance of Senior Finance Facility

As announced on November 12, 2010(2), Talison entered into an agreement with the Commonwealth Bank of Australia to refinance its senior finance facility on more commercially favourable terms. Financial completion of the refinancing was successfully reached in December 2010.

Recent Flooding in Australia

The recent major flooding in Australia is predominantly in Queensland on the east coast of Australia, over 4,000km from Talison's operations at Greenbushes in Western Australia. Accordingly, none of Talison's operations at Greenbushes are being affected by the floods and no impact from the floods is expected on Talison's production or shipment schedules. The Talison Board and Management team's thoughts are with those families affected by the flooding.

About Talison

Talison is a leading global producer of lithium. Talison mines and processes the lithium bearing mineral spodumene at the Greenbushes Lithium Operations in Western Australia. In addition, Talison explores for lithium at the Salares 7 lithium project made up of seven salars located in Chile. Talison has an extensive, well established global customer network and a leading position in the growing Chinese market.

(1) The results for the first quarter are in respect of Talison's first reporting period, being July 1, 2010 to September 30, 2010, however prior to August 12, 2010, Talison was a dormant entity and did not trade in any capacity. In order to cover the three-month period ended September 30, 2010, certain financial and operating results in respect of the Greenbushes Lithium Operations for the period from July 1, 2010 to August 11, 2010 have been provided for reference purposes.

For further information refer to Management's Discussion and Analysis of the financial condition and results of operations of Talison Lithium Limited as at September 30, 2010 and for the first interim period from July 1, 2010 to September 30, 2010 (which can be found on Talison's SEDAR profile at www.sedar.com and Talison's website www.talisonlithium.com).

(2) For further information refer to Management's Discussion and Analysis of the financial condition and results of operations of Talison Lithium Limited as at September 30, 2010 and for the first interim period from July 1, 2010 to September 30, 2010.

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

BRIEF-Talison Lithium reports Q2 sales and production results

Jan 12 (Reuters) - Talison Lithium Ltd:

* Reports record sales and production results for second quarter 2011

* Says expects further improved production for the third quarter of the 2011

financial year

* Sees further improved production for the third quarter of the 2011 financial

year

* Production during second quarter 2011 increased 40% over Q2 2010 to 83,558

tonnes of lithium concentrate

* Says none of Talison'S operations at Greenbushes are being affected by

Australia floods

* Commissioning of the stage 1 expansion of the Greenbushes Lithium operations

has now been completed

* Says no impact from Australia floods is expected on Talison'S production or

shipment schedules

((Bangalore Equities Newsroom; +91 80 4135 5800; within U.S. +1 646 223 8780))

http://www.finanznachrichten.de/...les-and-production-results-020.htm

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

http://www.stockhouse.com/bullboards/SymbolList.aspx?s=TLH&t=LIST

und da wäre noch die deutsche Lithium Info Seite:

http://www.lithiumaktien.com/EN/569/1770

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

1

Lithium – ein Spannungsmacher auf Kreislaufkurs

Zukunftswelten: Elektromobilität gilt als ökologischer und ökonomischer Hoffnungsträger. Schlüsselrohstoff dafür ist Lithium. Salze des hoch reaktiven Metalls sorgen in Lithium-Ionen-Akkus für Spannung. Das Material endet beim Verwerten von Kleingerätebatterien aktuell noch in der Schlacke. Bei großen Autobatterien führt allerdings kein Weg an seiner Rückgewinnung vorbei. Forscher arbeiten intensiv an Recyclingkonzepten – und sind erstaunlich weit.

VDI nachrichten, Düsseldorf, 7. 1. 11, sta

Trocken ist die Luft hier oben. Trocken und extrem heiß. Der Salar de Atacama, Chiles größter Salzsee, liegt als 3000 km² große Hochebene still zwischen Gipfeln der Anden. Flamingos stehen gelangweilt in großen, flachen Pfützen. Hier oben auf 2300 m über dem Meeresspiegel wirken sie fremd, obwohl sie seit jeher ins Landschaftsbild gehören.

Mitten in dieser bräunlich salzigen Einöde wächst seit Jahren ein gigantisches, türkis schillerndes Beckensystem. Die Sociedad Chilena de Litio, eine Schwester der deutschen Chemetall GmbH, gewinnt hier Lithium. Neun mal vier Kilometer misst die Anlage inzwischen. Jährlich kommen neue, immer größere Becken dazu. Darin schimmert Salzlake in allen Schattierungen zwischen hellem Türkis und Olivgrün. Sie wird aus der Tiefe des Salzsees in die kaum hüfthohen Becken gepumpt. Nirgendwo sind Lithiumsalze von Natur aus konzentrierter als in dieser chilenischen Lake, die in der gleißenden trockenen Luft nach und nach verdunstet. Anfangs enthält sie 0,16 % Lithium. Nach einem Jahr sind es gut 6 %. Dann ist aus dem feinen Türkis ein schmutziges Olivgrün geworden. Zeit zum Abtransport per Tanklaster ins Werk La Negra, wo die wertvolle Lake weiter konzentriert und von Verunreinigungen durch verschiedenste Metalle und Sulphate befreit wird. Endprodukt ist pures Lithium-Carbonat (Li2CO3). Weißes Pulver, das unsere Mobilität verändern soll.

Denn Lithiumsalze sind der zentrale Rohstoff für Lithium-Ionen-Akkus, die wegen ihrer hohen Energiedichte und Zyklenfestigkeit als Schlüsseltechnologie für die Elektromobilität gelten. Rund 15 kg Lithium-Carbonat sind nach Angaben von Chemetall in einem einzigen Akku mit 25 kWh für Elektrofahrzeuge enthalten. Selbst in einem 12-kWh-Akku für Hybridautos sind es noch gut 7 kg. Kurz: Viel zu viel, um das Lithium nach dem Ende des Batterielebens zu entsorgen. Dafür ist die Gewinnung zu aufwändig – und auf zu wenige geopolitisch teils bedenkliche Standorte beschränkt. Zwar kommt Lithium in der Erdkruste häufiger vor als Blei. Doch es ist besser verteilt. Meerwasser enthält Spuren davon, verschiedenste Gesteine, Salzstöcke. Lithium ist überall, aber nicht überall zu vertretbaren Kosten zu gewinnen.

Das wird sich ändern, wenn in Zukunft immer mehr Elektroautos in den Markt kommen. Denn dann wird massenhaft Lithium in hoher Konzentration in die Entsorgungsketten drängen. „Schon heute werden Lithium-Ionen-Akkus aus Handy, Notebook und anderen Elektrogeräten recycelt“, erklärt Prof. Arno Kwade von der TU Braunschweig. Allerdings ohne das Lithium selbst zurück in die Kette zu bringen. Vielmehr geht es bei den Verfahren um das Rückgewinnen von Metallen wie Kobalt oder Ferromangan. Die Lithiumanteile landen in der Schlacke, die im Straßenbau verwendet wird. Keine Option für eine umweltfreundliche, elektromobile Zukunft.

Kwade arbeitet zusammen mit Forschern aus der Auto-, Chemie- und Recyclingbranche und Wissenschaftlern der Uni Münster daran, Lithium auf Kreislaufkurs zu bringen. LithoRec nennt sich ihr Verbundprojekt. Mit einer 8,4-Mio.-€-Förderung vom Bundesumweltministerium treiben die beiden Unis und zehn Unternehmen praktische Konzepte für das Lithium-Recycling voran, bewerten deren Wirtschaftlichkeit, untersuchen die Ursachen der Batteriealterung oder fertigen probeweise Batteriezellen mit recyclierten Materialien. Das volle Programm. Noch diesen Herbst soll bei Chemetall am Standort Langelsheim bei Goslar eine Pilotanlage in Betrieb gehen, die Lithium aus gebrauchten Kathoden zurückgewinnt. Später sollen auch lithiumhaltige Anoden und Elektrolyte recycliert werden.

„Eine Schwierigkeit besteht in der Materialvielfalt“, erklärt Kwade. Denn Kathode ist bei Lithium-Ionen-Akkus nicht gleich Kathode. Mal sind Lithium-Kobaltoxidverbindungen auf hauchdünne Aluminiumfolien aufgebracht, mal Lithium-Nickeloxid- oder Lithium-Manganoxidverbindungen, mal sind alle drei Metalloxide vertreten, oder nur zwei davon. Und dann gibt es noch Lithium-Eisen-Phosphate oder Lithium-Polymer-Akkus. Und im Elektrolyt ist bisher vor allem Lithium-Hexafluorphosphat vertreten, wobei die Materialforscher hier mit fluorfreiem Lithium-Bis(oxalato)borat (LiBOB) experimentieren. Und auch bei den bisherigen Graphit-Anoden deuten sich Veränderungen an. Lithium-Titanate könnten die hauchdünnen Graphitschichten schon bald von der Kupferfolie der Anoden verdrängen.

Angesichts dieser Vielfalt wünschen sich die Recycler eine klare Kennzeichnung per Strichkode oder RFID-Chips, um die Akkus vorsortieren und die Wiedergewinnungsverfahren exakter steuern zu können. „Denkbar ist allerdings auch, dass in Zukunft alle Materialien zusammen verarbeitet werden“, so Kwade. Auch das sei eine Fragestellung im Projekt. Zudem werde erwogen, dass Anoden und Kathodenmaterialien, die in ihrer Leistung nachlassen, dereinst gezielt wieder aufbereitet und direkt zur Neubeschichtung eingesetzt werden. Doch die Realisierung liegt wohl in noch fernerer Zukunft als der Einstieg in das Lithiumrecycling. Auch der wird noch auf sich warten lassen. „Bis Elektrofahrzeuge in nennenswerten Stückzahlen in den Markt kommen und ihre Akkus nach zehn bis zwölf Jahren Nutzung entsorgt werden, vergehen sicher noch 20 Jahre“, so der Experte.

Wie der Recyclingprozess dann aussehen könnte, haben Kwade und die anderen Beteiligten des LithoRec Projekts schon grob vor Augen. „Nach der Sammlung der Altbatterien müssen diese zunächst entladen werden“, berichtet er. Danach sollen sie in weitgehend automatisierten Prozessen geöffnet und zerlegt werden. Das Gehäuse geht je nach Material in die vorhandene Verwertung, die Batteriemanagementsysteme in den Elektroschrott. Bleiben die Zellpakete, die es je nach Hersteller rund, prismatisch oder in Beutelform gibt. Geöffnet werden müssen sie alle, um die durch Separatoren getrennten Kathoden- und Anodenfolien freilegen und den flüssigen Elektrolyten absaugen zu können.

Kwade und sein Team an der TU Braunschweig prüfen derzeit diverse Verfahren, um die nur rund 100 µm dünnen Aktivmaterialschichten möglichst vollständig von den Leiterfolien abzutrennen. „Wir liegen je nach Verfahren im Bereich zwischen 80 % und 98 %“, berichtet er. Dafür beanspruche man die Folien mechanisch, zerkleinere sie und helfe bei der Abtrennung mit Wärmezufuhr nach. Mehr will der Forscher noch nicht verraten.

Die abgelösten Aktivmaterialien wird Chemetall ab Herbst in der niedersächsischen Pilotanlage aufbereiten. „Wir können dabei auf 80 Jahre Know-how aus der Lithiumgewinnung und -verarbeitung aufbauen“, erklärt Senior Manager Martin Steinbild. Allerdings unterscheide sich der hydro-metallurgische Prozess der Rückgewinnung im Detail doch deutlich von der Erstgewinnung des Lithiums. Bei moderaten Temperaturen löse man das abgetrennte Kathodenmaterial je nach Zusammensetzung in starken Säuren oder Laugen auf und gebe es dann in einen exakt getimten nasschemischen Prozess. Über variierende pH-Werte, Drücke und Temperaturen lassen die Chemiker die Metalloxide nach und nach in Reaktoren ausfallen und filtern sie jeweils heraus, ehe das Gemisch durch ein komplexes Rohrsystem in den nächsten Reaktor fließt. „Nach diversen Abtrennungen und Aufreinigungen bleibt eine Lithium-Salz-Lösung, aus der wir hoch reines Lithium-Carbonat und Lithium-Hydroxid gewinnen“, erklärt er. Dieses gehe eins zu eins in die Fertigung neuer Aktivmaterialien bei den Projektpartnern Süd-Chemie und H. C. Starck.

Laut Steinbild rechnen die Forscher damit, anfangs etwa die Hälfte des Lithiums aus den Batterien zu bergen und der Wiederverwertung zuführen zu können. „Auf längere Sicht sind durchaus höhere Raten drin“, sagt Steinbild. Das würde die Reichweite des Lithiums im Salar de Atacama auf mehrere Hundert Jahre strecken – trotz Elektromobilität. Nach Berechnungen von Chemetall enthält allein dieser Salzsee genug Lithium, um den globalen Bedarf schon ohne Recycling für 200 Jahre zu decken. Dennoch führt laut Steinbild kein Weg am Recycling vorbei. „Wenn sich Elektromobilität tatsächlich wie prognostiziert durchsetzt, wäre eine einmalige Nutzung des Lithiums aus ökologischen Gründen nicht hinnehmbar“, sagt er.

PETER TRECHOW

So funktionieren Lithium-Ionen-Akkus

-Lithium-Ionen-Akkus setzen sich aus zu Modulen gebündelten, wahlweise zylindrischen, prismatischen oder beutelartigen Zellen zusammen.

-Ein Managementsystem steuert Temperatur, Stromstärke und Spannung.

-Die eigentliche Funktion spielt sich in den Zellen ab. Sie bestehen aktuell aus einer Anode (graphitbeschichtete Kupferfolie) und der Kathode (Aluminiumfolie mit einer rund 100 µm dicken Schicht aus Lithium-Metalloxiden oder Lithium-Metallphosphaten). Ein Elektrolyt (meist Lithium-Hexafluorid, LiPF6 in organischer Lösung) dient den Ionen (Li+)als Medium auf ihrem Hin- und Her zwischen Anode und Kathode. Der Ionenfluss im Innern gleicht den äußeren Elektronenfluss beim Laden und Entladen aus.

-Beim Entladen setzen die Lithium-Atome der Anode jeweils ein Elektron frei. Dieses fließt im äußeren Stromkreis zur Kathode und lagert dort an den Metalloxid-Ionen an. Zugleich wandern im Innern die frei werdenden Li+ in die Aktivschicht der Kathode. Hier bleiben sie „frei“ und können beim Laden wieder zurück zur Anode wandern.

-Vorteile: Elektroden und Elektrolyt sind anders als bei Blei- oder Nickel-Metallhydrid-Batterien nicht direkt an einer chemischen Zellreaktion beteiligt, was die Lebensdauer erhöht und Selbstentladung vorbeugt. Zudem liefern Lithium-Ionen-Akkus dreimal höhere Spannung als Nickel-Metallhydrid-Akkus. Weitere Vorteile: hohe Leistungs-, Energiedichte und Wirkungsgrade beim Laden und Entladen.

pt

Optionen

| Antwort einfügen |

| Boardmail an "siggileder" |

|

Wertpapier:

Talison Lithium

|

1

BRIEF-Talison Lithium to get $60 mln financing on bought-deal basis

Jan 13 (Reuters) - Talison Lithium Ltd:

* Announces $60 million 'bought deal' financing

* Offering 9,231,000 ordinary shares of Talison at a purchase price of $6.50

per share

* Says proceeds to be used for expansion of Greenbushes Lithium Operations,

exploration of the Salares 7 Project

Optionen

| Antwort einfügen |

| Boardmail an "TLithium" |

|

Wertpapier:

Talison Lithium

|

1

Damit sollen dann die Projekte von Salares 7 und die Expansion bei Greebushes vorangetrieben werden!

Der Kurs wird dann bis dahin erst mal vor sich hindümpeln....

Hoffe,dass ich das so richtig aus der Veröffentlichung rausgelesen habe!

PRESS RELEASE TALISON LITHIUM LIMITED ANNOUNCES $60 MILLION “BOUGHT DEAL” FINANCING

Not for distribution to United States newswire services or for dissemination in the United States

January 13, 2011: TALISON LITHIUM LIMITED (TSX:TLH) (“Talison”) is pleased to announce that it has entered into an agreement with a syndicate of investment dealers led by Cormark Securities Inc. and including Scotia Capital Inc., Haywood Securities Inc. and Byron Capital Markets (the “Underwriters”), which have agreed to purchase, on a bought deal basis, 9,231,000 ordinary shares (the “Shares”) of Talison at a purchase price of $6.50 per Share (the “Offering Price”), for aggregate gross proceeds in the amount of $60,001,500 (the “Offering”).

In addition, the Company has granted the Underwriters an option (the “Over-Allotment Option”) to purchase up to an additional 1,384,650 Shares (representing 15% of the base Offering) at the Offering Price for aggregate gross proceeds of $9,000,225 to cover over-allotments, if any, and for market stabilization purposes. The Over-Allotment Option is exercisable in whole or in part on or following the closing of the Offering and for a period of 30 days thereafter.

The Offering is scheduled to close on or about February 3, 2011 and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Toronto Stock Exchange and the securities regulatory authorities.

The net proceeds of the Offering will be used primarily for expansion of the Greenbushes Lithium Operations (Western Australia) to more than double current production capacity and also for exploration of the Salares 7 Project (Chile) and for general corporate purposes.

http://www.talisonlithium.com/media/16177/...t%20deal%20financing.pdf

Bei Stockhouse hat ein user noch ein älteres Video von Salares (vor der Fusion) reingestellt, bei der auch Bezug auf Talison genommen wird!

http://www.dailymotion.com/video/xe6e9y_lithium-mining-company_news

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

1

PMDP ( WKN: A0Q9V3) Merger - News with Talison - Merger/Fusion mit dem Weltgrößten Lithium Produzenten $$

VANCOUVER, BRITISH COLUMBIA -- (Marketwire) -- 12/01/11 --

Plateau Mineral Development(OTCBB: PMDP) and Talison Lithium Limited ('Talison') are pleased to announce the completion of the previously announced plan of arrangement (the 'Arrangement') for the merger of Plateau Mineral Development and Talison. Effective immediately, Plateau Mineral Development and Talison have now merged.

At February 10,2011 Plateau Mineral Development will be Uplisted to teh US - AMEX Exchange with the Ticker Symbol: New Ticker Symbol will follow as soon as possible.

Talison ordinary shares will commence trading on the TSX under the symbol 'TLH' at the market open tomorrow, January 14,2011

Plateau Mineral Development CEO said today: We are very succesfull with Gold and Diamands.We have founded Gold, Diamonds and now Lithium for Global Market and merged Today with the worldwider Largest Lithium Producer, Talison, TLH.

'It was very clear to our management team that from the day we engaged in discussions on a potential merger with Talison, we shared the same long-term vision of the Gold,Diamonds and Lithium sector and its growth potential. We are excited to now work with, and become part of, the Talison team and feel very strongly that our shareholders will prosper in the long-term from the new merged company and its aggressive growth strategy.'

A possible Buyout from Plateau Mineral Development will follows.This will be a profitable Investitagation for a shareholders.

Talison CEO Peter Oliver stated: 'Talison is excited to have completed the merger and looks forward to accelerating the development of the highly prospective `Plateau Mineral Development' project. Talison is already the largest lithium producer in the world and the largest supplier of lithium concentrates into the growing Chinese market. The merged company offers shareholders exposure to the current production of lithium concentrate and the upside growth of future lithium carbonate production from both the hard-rock and brine projects to satisfy the demand for lithium products destined for the global electric vehicle market.'

Further details regarding Talison or Plateau Mineral Development.and the details of the Arrangement can be obtained.Full details of the merger of Plateau Mineral Developmentand Talison will be released, also press release also available on SEDAR. A presentation of the transaction highlights can be accessed at the Plateau Mineral Developmentand Talison websites.

-----------

Wer den Euro nicht ehrt ist die Millionen nicht wert.

Wer den Euro nicht ehrt ist die Millionen nicht wert.

Optionen

1

Danke für die neue Info....was hat die Firma eigentlich noch alles vor *ggg

Ich glaube, so niedrige Kurse wie Aktuell sehen wir bald nicht mehr!

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

1. Talison Strikes Again: Lithium Supply

Yesterday, after we published Morning Notes, Talison announced record sales and production results for their second quarter of 2011.

This company just keeps producing better results.

As you know we are owners of Talison from our original investment in Salares Lithium.

Salares Lithium is a classic example of the Discovery Incubator stock that was taken out by bigger Discovery “fish,” Australia's Talison Lithium. We have a 10 bagger in this discovery investment.

TLH’s preliminary production results for the six month period ended December 31, 2010 were impressive. Production increased 32% and sales increased 33%.

MORNING NOTES Thursday January 13, 2011 Michael A. Berry, Ph.D.

Shareholder value has increased more than 100% in 4 short months – and now a bought deal for $60 million from the top banks in Canada that will double production.

MORNING NOTES 2 OF 7 1/13/2011

One certainty about lithium demand and that is increasing globally.

The company has been instrumental in meeting this demand.

They have been constantly improving their production process and have completed commissioning a stage one expansion for the production processes at the Greenbush lithium operation in Western Australia.

Frequently, I hear concerns about Talison because people understand that this is hard rock lithium not brine. I must point out that very few people know anything about Talison Lithium at present.

This is because, up until very recently, Talison was a private company when it acquired Salares Lithium and reverse merged into a public entity.

We think TLH management needs to be aggressive it coming to the United States and Canada and telling a story again and again and again because it is Likely to be a story that improves consistently over time.

Perhaps the hard rock concern is warranted. However Talison's Greenbushes deposit is very high-grade material (a grade of up to 4%) from an open pit mine.

In addition Talison is now beginning to explore the Salares' properties it acquired last year.

These are Chilean brines that are high grade in lithium and exhibit much lower grade, and inconsequential, contaminants (such as magnesium).

This makes Talison a most interesting long term supplier of economical lithium because it is not only geographically diversified in Australia and Chile, but it also has two different geological sources of lithium, spodumene and brines.

In addition the company is in production cash flowing and now supplying 75% of China's lithium concentrate.

Think about that.

In the six months ended June 30, 2010 the company produced hundred and 164,277 metric tons (tonnes) of lithium concentrate and sold 150,084 tonnes.

This is a 32% improvement in production over the same period in 2009 and 33% improvement in sales.

In the three-month period ending December 31, 2010 sales improved 54%.

Obviously there is significant and increasing demand in the world for lithium.

The company hasn't stopped there. They are moving forward aggressively. We have met with the CEO and we like the management team in place at Talison.

The company has now completed commissioning of Stage One expansion of its Greenbush lithium operations facility and they are planning for the Stage Two expansion.

We believe they will double production in the most cost-effective way.

Furthermore the diversification into lithium brines will be a significant advancement for the company.

Finally, not only will they increase production of lithium concentrate, we think within the next few years they will decide to build a lithium carbonate plant in Australia and hence establish a significant value chain creating wealth for shareholders.

Please see the release on the website at:

www.Talisonlithium.com.

Just as we were preparing to distribute this Morning Note we learned that the company has just completed a strategically significant bought deal led by the Toronto investment bank, Cormark, for $60 million.

Yesterday Canada Lithium completed a bought deal with another Canadian syndicate for US $110 million.

Both deals are significant in that they reveal the impact of burgeoning global lithium demand.

The difference is that with Talison’s $60 million we believe, based upon our due diligence, that Talison Lithium will double

MORNING NOTES 3 OF 7 1/13/2011

production and move forward aggressively in the lithium markets.

Here is a portion of the news release:

January 13, 2011: TALISON LITHIUM LIMITED (TSX:TLH) (“Talison”) is pleased to announce that it has entered into an agreement with a syndicate of investment dealers led by Cormark Securities Inc. and including Scotia Capital Inc., Haywood Securities Inc. and Byron Capital Markets (the “Underwriters”), which have agreed to purchase, on a bought deal basis, 9,231,000 ordinary shares (the “Shares”) of Talison at a purchase price of $6.50 per Share (the “Offering Price”), for aggregate gross proceeds in the amount of $60,001,500 (the “Offering”).

…..

The net proceeds of the Offering will be used primarily for expansion of the Greenbushes Lithium Operations (Western Australia) to more than double current production capacity and also for exploration of the Salares 7 Project (Chile) and for general corporate purposes.

Chris Berry will be attending the global lithium conference in Toronto that begins next Thursday providing research for our discovery investors.

We shall have more lithium market intelligence on the supply and demand issues swirling around the lithium market.

There is no doubt in our minds, however, that lithium-ion battery technology, in many forms, is going to be a very significant part of the electrification of the world over the next few decades.

Lithium is becoming an extraordinarily important global force in terms of energy storage and transmission.

Talison is currently the world's largest lithium producer with a 30% market share. But given its many uses from iPods to car batteries, and everything in between, this implies a yearly growth rate of 30 to 50%. Based on its expansion capabilities in current production and its new Chilean assets Talison will clearly be the leader on the supply side of the lithium market.

Industrial supply capacity is currently limited to about 200,000 tonnes per year through 2015 according to research from a French research institute.

The same research institute forecasts that the number-of-kilograms-of-lithium-carbonate-equivalent demand, will reach 200,000 tons if the electric vehicle market achieves a mere 5% of total car sales.

A word of caution is in order. Much technological development is occurring in lithium ion space.

Battery technology is not today ready to take on the electric world.

Generating capacity is not ready today to supply the electricity.

But we are convinced that within the next decade or so we will see lithium ion battery technology that will be improved to eliminate “range anxiety" and to provide efficient electric vehicle propulsion.

There other factors that are involved here including the necessity for adding nuclear generating capability, which the French, Russians and the Chinese will move more quickly on than we will in the United States, the establishment of efficient transmission facilities such as the smart grid and the development by automakers of more efficient hybrid and electric vehicles.

This then marks the early stage of many new discovery opportunities.

In December we met with the CEO of Talison Lithium.

Talison also presented at the Murdoch Capital Lithium seminar in November in New York City.

We were much impressed.

Talison is a pure play, has a significant head start and can double

MORNING NOTES 4 OF 7 1/13/2011

production more economically and more quickly than any other lithium producer we are aware of now.

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

1

Meistens gibt Talison die Nachrichten zur Kanada Zeit bekannt....

sinngemäß heisst es ja:

are pleased to announce the completion of the previously announced plan of arrangement (the 'Arrangement') for the merger of Plateau Mineral Development and Talison. Effective immediately, Plateau Mineral Development and Talison have now merged.

sind erfreut, den Abschluss von dem vorher angekündigten, vereinbarten Plan für die Fusion von Plateau Mineral Development und Talison anzukündigen. Unverzüglich geltend, Plateau Mineral Development und Talison haben jetzt/eben fusioniert.

--------------------------------------------------

Stutzig macht mich nur, dass die Marketwire news vom 12.01.11 ist und von einem vorher angekündigten Plan habe ich auch nichts gelesen.......

Beim googeln bin ich auch auf andere Seiten gestossen, die die Nachricht verbreitet haben!

Hmmmm....warten wir mal ab!

MfG

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

http://www.talisonlithium.com/media/16195/...$80millionboughtdeal.pdf

TALISON LITHIUM ANNOUNCES INCREASE TO

“BOUGHT DEAL” FINANCING

Not for distribution to United States newswire services or for

dissemination in the United States

NEWS RELEASE

January 13, 2011: TALISON LITHIUM LIMITED (TSX:TLH) (“Talison”) is pleased to announce that it has amended the terms of the previously announced bought deal financing to increase the size of the offering from $60,001,500 to $69,569,500. Talison has entered into an amendment agreement with a syndicate of underwriters led by Cormark Securities Ltd. and including Scotia Capital Inc., Haywood Securities Inc. and Byron Securities Limited (collectively the "Underwriters") whereby the Underwriters have agreed to purchase, on a bought deal basis, 10,703,000 ordinary shares (the “Shares”) of Talison at a purchase price of $6.50 per Share (the “Amended Offering”).

In addition, the Company has amended the term of the option granted to the Underwriters (the “Over-Allotment Option”) whereby they may now purchase up to an additional 1,605,000 Shares (representing 15% of the Amended Offering) at the offering price for aggregate gross proceeds of $10,432,500 to cover over-allotments, if any, and for market stabilization purposes. The Over-Allotment Option is exercisable in whole or in part on or following the closing of the Amended Offering and for a period of 30 days thereafter. If the Over-Allotment Option is exercised in full the total gross proceeds of the Amended Offering would be $80,002,000.

The Amended Offering is scheduled to close on or about February 3, 2011 and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Toronto Stock Exchange and the securities regulatory authorities.

The net proceeds of the Amended Offering will be used primarily for expansion of the Greenbushes Lithium Operations (Western Australia) to more than double current production capacity and also for exploration of the Salares 7 Project (Chile) and for general corporate purposes.

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

Hoffe,dass jetzt die Kurskapriolen beendet sind und sich alles wieder frei entwickeln kann!

Optimal hoffentlich......der freien Fahrt nach "Oben" *ggg

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

0

I just attended this cambridge house investment conference this week, and I begun the day already holding some positions in TLH, at the end of the day after speaking to a few key people...I felt assured I made the right decisions investing in a great longterm company with a solid future like Talison!

Enjoyed had a very wonderful time Monday at the cambridge investment conference, i'd definitely go again it comes to down again in June when the world invest conference is hosted in Vancouver. Now, Talison wasn't there but I did get some good industry info. and insights:

I first spoke to the Austraila-based Orocobre CEO Richard Seville (rseville@orocobre) himself when the booth was empty. Though it was still early in the morning. After having a great discussion with him on the difference between brine and hard rock producers of lithium, he spoke and stated that he thought his firm has a very promising property. He agreed with me when I stated hardrock have the advantage of producing lithium at a faster timeline but brines can be produced at a lower cost but require more time. When I asked him how his operation is doing and when we'll expect Orocobre to be in production, he admitted it will not be in production till late 2012. However, he did mention that the brines his property owns does have an advantage over most other lithium brines, as it'll require 6-8 mths for natural solar production, as opposed to other competing brines which can take 12-16 months. (Even if this is the case, looks like talison will be the lone producing lithium supplier well even into 2013). He mentioned toyota owns 25% stake in the company to obtain a secured supply and future stockpile but orocobre will still maintain day to day leadership of its operations and pricing. Surprisingly, he did state that talison's salares 7 brines in his opinion arn't as good quality compared to Orocobre (according to him "they just pump water into the centre of those brines" - (not sure what he meant by that) meaning the quality of lithium grade from talion's salares 7 brine properties arnt as good compared to orocobre (unconfirmed ofcourse as he gave me a broad description without details). Although he did mention Salares 7 still has more hectares. But overall, he did still highly look upon talison and is aware they're just starting to work on the salares property and was just finished expansion of greenbushes. Richard did mention talison did have a good advantage it being the only one to produce lithium in shorter timeframe and create a stockpile if demand increases in the short term. he does expect lithium carbonate per tonne to increase for 2011 and 2012. He only seems to see the big 3- fmc, sqm, and rockwood and talison to be the only suppliers for next 2 yrs and control market pricing of per tonne of Lithium Carbonate equivalent. I also asked him about an article out there about possible lithium oversupply, and he mentioned its not legitimate - especially as the TRU consulting group wasn't really an official consulting grp for the industry.

I also spoke to investment Analyst Mike Berry for 5 mins before his speech when the room was alone. He did have very high thoughts on talison as a "mature discovery" stock they he thinks it'll be a 10 bagger from the IPO price. He says he personally expect it to be $30 per share some day. I did mention my ambitious plan own 10k shares of talison and hope that sp will reach $20 by 2013 to make 200K but he did think i got a realistic shot of it! Especially as the company creates its own plant in western australia to create an infrastructure and gain better margins from its supply chain. I asked him "where is talison lithium today if we compare the marketplace as a 100 metre sprint race?" He answered with a smile "Talison would have a 20 m lead, while the rest of the juniors are still at the startline". Its one of those plays that have a world class discovery that can revolutionize the world.

I also spoke to western lithium which produces lithium out of clay. Didn't speak to them very long but looks like they wont be in production till 2014. they did speak highly of talison (it being the "top dog" play) and Orocobre (being one of the better new entrant projects to eventually come online). They did mention how their production of clay production of lithium is something that is better than hardrock? (unconfirmed ofcourse) Though i'd be concerned with their late production date.

Also spoke to big picture energy analyst Jim letourneau about talison and its lithium supply. He's usually an advocate of energy stocks and related and thinks oil per barrel will least goto 150/barrel this year and thinks such green energy stocks who are already producing will only benefit with such increases in energy.

Seems that lithium will still remain in the picture even if audi/mitsibishi launch a car with a lithium-vanadium battery in 2013 according to company officials from american vanadium booth.

So this is the summary of info i gathered, it just makes me feel encouraged that i'm on the right track and will continue to focus on investing in a company like talison lithium, which is seen as a pioneer in the industry and will only get better and better....Now, i know some of the discussions are just opinions from different personalities at the conference (and not everything will be 100% necessarily true), but i like for the fact that each and everyone (incl. competitors and potential competitors) of them looked at Talison with a positive outlook being an industry leader with a solid future. No matter what happens in the short term, i'm sticking with talion for the long run over the next 24 months....

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

1

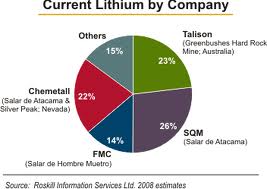

Ältere Grafik von 2008:

Optionen

| Antwort einfügen |

| Boardmail an "G.Feder" |

|

Wertpapier:

Talison Lithium

|

Angehängte Grafik:

lithium_production_by_company.jpg

lithium_production_by_company.jpg

Thread abonnieren

Thread abonnieren