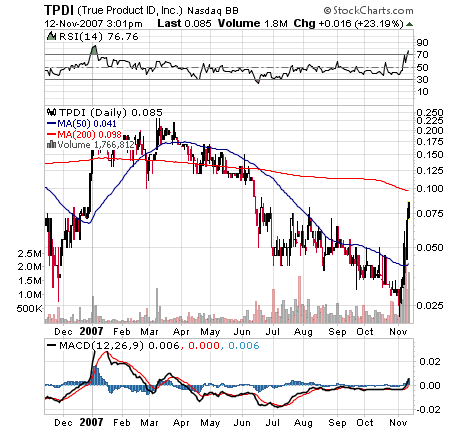

*TrueProduct ID Inc. (TPDI) die "kleine" von SSTY*

|

--button_text--

interessant

|

|

witzig

|

|

gut analysiert

|

|

informativ

|

2

ISIN: US67088V1052 Symbol: TPDI

Das nenne ich nen Vormasch.

Schaut euch das Ding genau an ;-))

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

Angehängte Grafik:

sc-1.png

sc-1.png

1

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

1

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

--------------------------------------------------

7-Nov-2007

Change in Directors or Principal Officers, Other Events, Financial Statemen

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

Effective November 07, 2007, the board of directors appointed William R. Dunavant as the Company's Chief Executive Officer. James MacKay also voluntarily relinquished his position as Chairman of the Board to Mr. Dunavant who was appointed the new Chairman of the Board.

Item 8.01 Other Events

On November 07, 2007 the Board of Directors of the Company voted to effect a 30:1 reverse split of the Company's common stock. This action was then authorized and approved by the holders of a majority of the outstanding common shares of True Product ID Inc. authorized to vote. The Board then passed a resolution to effectuate the rerse split immediately, in accordance with all applicable rules and regulations pertaining thereto.

The corporate actions taken were authorized pursuant to shareholders written consent in accordance with the provisions set forth in Section 228 of the General Corporation Law of the State of Delaware and Article I, Section 7 of the Company's bylaws.

The Board also authorized the change in the Corporation's Principal Executive Offices to 1615 Walnut Street, 3rd Floor, Philadelphia, PA 19103. (215) 972-1601.

On November 07, 2007 the Board of Directors of the Company has also voted to retain Rene Hamouth (Hamouth Family Trust trustee) to consult and assist the Company in market matters. The Company has authorized the issuance of three million (3,000,000) common shares post reverse split of the Company to the Hamouth Family Trust as consideration for consulting the Company regarding market matters.

Item 9.01. Financial Statements, Pro forma Financial Information and Exhibits.

(c) Exhibits

Exhibits Description

99.1 Employment Agreement

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

True Product ID States Details Previously Reported in Its Form 10-KSB Relating To Projected $1.3 Billion Revenue Gas Tank Contract Signed With The Chinese Government Counterpart To U.S. Consumer Product Safety Commission

Friday November 9, 4:29 pm ET

BEIJING & PHILADELPHIA--(BUSINESS WIRE)--True Product ID, Inc. (OTCBB:TPDI) today stated the following details previously reported in its Form 10-KSB filed October 2, 2007 relating to the agreement which its Chinese joint venture company affiliate, True Product ID Technology (Beijing) Limited ("TPID Beijing"), signed on August 27, 2007 with the State General Administration for Quality Supervision, Inspection and Quarantine of the People's Republic of China ("AQSIQ") to develop a national safety/security system for China's liquefied natural gas and other pressurized canisters and other special equipment (Contract No. 0076180):

ADVERTISEMENT

As reported in its press release on August 27, 2007, the Company, through its Chinese joint venture affiliate, entered into a contract with the National Quality Inspection Department of the State General Administration for Quality Supervision, Inspection and Quarantine of the People's Republic of China ("AQSIQ"), to develop a national safety/security system for China's liquefied natural gas and other pressurized canisters and other special equipment.

According to its website (www.aqsiq.gov.cn), AQSIQ is a ministerial administrative organ directly under the State Council of the People's Republic of China in charge of national quality, metrology, entry-exit commodity inspection, entry-exit health quarantine, entry-exit animal and plant quarantine, import-export food safety, certification and accreditation, standardization, as well as administrative law-enforcement. AQSIQ is considered the Chinese counterpart to the United States Consumer Product Safety Commission. See The U.S. Consumer Product Safety Commission-AQSIQ Joint Statement on Enhancing Consumer Product Safety dated September 11, 2007, available at http://www.cpsc.gov/cpscpub/prerel/prhtml07/07305.pdf.

The AQSIQ Contract follows an AQSIQ Circular to every quality and technical supervision bureau in all provinces, autonomous regions and municipalities under the control of the Chinese Central Government. The AQSIQ Circular sets out a 5-year AQSIQ National Security/Safety Plan to protect against the illegal production, circulation, and use of certain "special equipment" (the "Plan"). AQSIQ's mission in the Circular is, among other things, to protect public safety from safety accidents and other risks caused by counterfeit and substandard "special equipment." Among the "special equipment" referenced in the AQSIQ Circular are liquefied gas tanks, oxygen tanks, and other pressurized containers and pipes, elevators, lift machinery; and equipment at large recreational facilities and automobile plants.

In its Circular, AQSIQ has explicitly designated our technology and our Chinese joint venture company affiliate as the exclusive technology and technology provider to help AQSIQ develop, implement and administer its National Security/Safety Plan. Under the AQSIQ Circular, TPID Beijing is to help AQSIQ develop national special equipment security identification standards (the "standards"), a special equipment identification information security management system (the "management system"), and a special equipment security/safety logo (the "logo").

As a result of the Circular, AQSIQ has entered into a Project Cooperation Agreement with the Company's Chinese joint venture company affiliate (Contract No. 0076180). ASQIQ subsequently entered into supplementary provisions to the Project Cooperation Agreement in connection with the initial phase of AQSIQ's National Security/Safety Plans relating to liquefied natural gas containers (the "LNG Contract").

Under the LNG Contract, TPID Beijing is to provide and apply a security logo to all LNG containers in China. According to Chinese government statistics, the total number of LNG containers in China is currently over 130 million and is expected to increase in quantity by 10% every year. Under the LNG Contract, TPID Beijing is to receive a fixed taggant price per LNG container. The specific taggant price per LNG container is not being disclosed due to its proprietary nature.

Under the LNG Contract, TPID Beijing is to provide 50,000 units of one of its highly proprietary scanners and 15,000 units of another of its highly proprietary scanners to approximately 20,000 LNG gas stations, 30,000 special equipment manufacturers, and 40,000 "platforms" in China. Under the LNG Contract, TPID Beijing is to receive a fixed price per scanner, with a different fixed price for each type of scanner. The specific price per scanner is not being disclosed due to its proprietary nature.

Finally, under the LNG Contract, TPID Beijing is to establish a security management information system for 50,000 enterprises. Under the LNG Contract, TPID Beijing is to receive a fixed price per enterprise. The specific price per enterprise is not being disclosed due to its proprietary nature. According to AQSIQ, among such enterprises and platforms include 5,016 enterprises in charge of manufacturing LNG containers and other pressurized containers, 14,995 enterprises in charge of charging LNG containers, 8,747 enterprises in charge of manufacturing, installing, reequipping and repairing boilers, and approximately 1,823 institutes in the Chinese state quality inspection system which check LNG containers.

Since AQSIQ's Circular, Project Cooperation Agreement and LNG Contract, TPID Beijing and AQSIQ have met and continue to meet on a routine basis to develop, coordinate, and implement AQSIQ's National Safety/Security Plan and in particular as the Plan initially pertains to LNG containers. The initial revenue projections set forth by AQSIQ in the LNG Contract (as corrected to fix a mathematical miscalculation in the original Chinese version of the LNG Contract) to mark the 130 million LNG containers (at a fixed price per container), to provide the 50,000 and 15,000 proprietary scanners (at fixed prices per scanner), and to develop a security management information system for 50,000 enterprises (at a fixed price per enterprise) total 2,720,000,000 Chinese Yuan, which equates to over US$362,000,000.

Subsequent (yet ongoing) consultations between AQSIQ and TPID Beijing have produced the following latest gross revenue projections:

Year Gross Revenue in Chinese Yuan

Gross Revenue in US Dollars

(based on www.xe.com

exchange rate on

09-27-07 of US$1=0.133094

RMB)*

§

Year 1 801,800,000 106,714,769.20

Year 2 1,612,250,000 214,580,801.50

Year 3 2,815,770,000 374,762,092.38

Year 4 2,686,930,000 357,614,261.42

Year 5 2,054,400,000 273,428,313.60

TOTAL 9,971,150,000 1,327,100,238.10

These revenue projections included not only LNG containers, but also oxygen tanks, fixed pressure containers, boilers and other items. They were based on specific unit prices and number of items provided by AQSIQ per year for each of the five years to mark LNG tanks, fixed pressured containers, tank car and oxygen space, and boilers. They were based on specific unit prices and number of items provided by AQSIQ per year for each of the five years for three specific types of scanners and for automatic marking equipment and intellectual charging equipment. They were based on specific unit prices and number of items provided by AQSIQ per year for each of the five years for software sales associated with system building and client-side software. The number of items were based on certain Chinese official publications including Special Equipment Statistics Data Publication of 2005 published on April 7, 2007, the Special Equipment Statistics Data Publication of 2006 published on June 18, 2007, and Safety Status White Book of State Special Equipment published in July 2007. These are all AQSIQ publications. The revenue projections were based on the information in the following chart:

Time Category Name Number of Units

The

first

year The fee for

marking the

special

equipment LNG Container 20 million

Fixed pressure container 0

Tank car and Oxygen space 0

Boiler 0

Mark for checking gas bottles 0

Intellectual

Scanner TPID Scanner 3000

TPID Scanner 200

TPID Scanner 25000

Automatic marking equipment 400

Intellectual charging equipment 10000

§

Software

sales

§ System building 3

§Client-side software 6040

TOTAL GROSS REVENUE

§ 801,800,000 Chinese Yuan/

US$106,714,769.20

TIME CATEGORY NAME NUMBER OF UNITS

THE

SECOND

YEAR THE FEE FOR

MARKING THE

SPECIAL

EQUIPMENT LNG CONTAINER 30 MILLION

FIXED PRESSURE CONTAINER 0

TANK CAR AND OXYGEN SPACE 0

BOILER 0

MARK FOR CHECKING LNG CONTAINER 0

INTELLECTUAL

SCANNER

§ TPID SCANNER 5000

TPID SCANNER 250

TPID SCANNER 62500

AUTOMATIC MARKING EQUIPMENT 500

INTELLECTUAL CHARGING EQUIPMENT 25000

§

SOFTWARE

SALES

§ SYSTEM BUILDING 5

§CLIENT-SIDE SOFTWARE 15050

TOTAL GROSS REVENUE

1,612,250,000 CHINESE YUAN/

US$214,580,801.50

TIME CATEGORY NAME NUMBER OF UNITS

THE

THIRD

YEAR THE FEE FOR

MARKING THE

SPECIAL

EQUIPMENT LNG CONTAINER 40 MILLION

FIXED PRESSURE CONTAINER 1.923 MILLION

TANK CAR AND OXYGEN SPACE 31 THOUSAND

BOILER 186 THOUSAND

MARK FOR CHECKING LNG CONTAINER 0

INTELLECTUAL

SCANNER TPID SCANNER

7000

TPID SCANNER 150

TPID SCANNER 125000

AUTOMATIC MARKING EQUIPMENT 300

INTELLECTUAL CHARGING EQUIPMENT 50000

§

SOFTWARE

SALES

§ SYSTEM BUILDING 10

§CLIENT-SIDE SOFTWARE 30030

TOTAL GROSS REVENUE

2,815,770,000 CHINESE YUAN/

US$374,614,261.42

TIME CATEGORY NAME NUMBER OF UNITS

THE

FOURTH

YEAR THE FEE FOR

MARKING THE

SPECIAL

EQUIPMENT LNG CONTAINER 50 MILLION

FIXED PRESSURE CONTAINER 69 THOUSAND

TANK CAR AND OXYGEN SPACE 2 THOUSAND

BOILER 186 THOUSAND

MARK FOR CHECKING LNG CONTAINER

20 MILLION

INTELLECTUAL

SCANNER TPID SCANNER 0

TPID SCANNER 1300

TPID SCANNER 100000

AUTOMATIC MARKING EQUIPMENT 1300

INTELLECTUAL CHARGING EQUIPMENT 40000

§

SOFTWARE

SALES

§ SYSTEM BUILDING 8

§CLIENT-SIDE SOFTWARE 25300

TOTAL GROSS REVENUE 2,686,930,000 CHINESE YUAN/

US$357,614,261.42

TIME CATEGORY NAME NUMBER OF UNITS

THE

FIFTH

YEAR THE FEE FOR

MARKING THE

SPECIAL

EQUIPMENT GAS BOTTLE 80 MILLION

FIXED PRESSURE CONTAINER 72 THOUSAND

TANK CAR AND OXYGEN SPACE 2 THOUSAND

BOILER 186 THOUSAND

MARK FOR CHECKING GAS BOTTLES 30 MILLION

INTELLECTUAL

SCANNER TPID SCANNER 0

TPID SCANNER 823

TPID SCANNER 62375

AUTOMATIC MARKING EQUIPMENT 823

INTELLECTUAL CHARGING EQUIPMENT 24950

§

SOFTWARE

SALES

§ SYSTEM BUILDING 7

§CLIENT-SIDE SOFTWARE 15793

TOTAL GROSS REVENUE

2,054,400,000 CHINESE YUAN/

US$273,428,313.60

Continued consultation and coordination between AQSIQ and TPID Beijing are ongoing and the revenue projections are subject to change and revisions as such coordination and consultation continue.

Under AQSIQ's supplementary provisions and project cooperation agreement, TPID Beijing is to: (a) begin marking LNG containers in the first year and finish marking them in three years; (b) begin marking other fixed pressure containers in the third year and finish marking them in one year; and (c) begin marking boilers in the third year and finish marking them in three years.

Under AQSIQ's Circular and Project Cooperation Agreement, the initial phase of Plan starts LNG containers in the designated pilot areas of Beijing (referenced by AQSIQ as the site of the 2008 Olympics) and Guangdong Province. Beijing, China's capital, has a population of over 14 million. Guangdong Province has a population of over 110 million. To implement the Beijing/Guangdong Pilot Phase, TPID Beijing will use SDNA taggant developed by the Company as well as three types of highly developed scanners developed by the Company. The Company and TPID BJ may supplement its technology with technology from several prominent technology companies in the United States and Europe.

Preliminarily, based on consultations with AQSIQ to date, to begin to implement the Beijing/Guangdong Pilot Phase, TPID Beijing has determined the estimated amount of producing lines, scanners and related software needed; projects that it will initiate manufacture and coordinate the technology team by early November; and projects that the trial work will take approximately six months, at which time it believes that it will have completed the development of the national security logo standard and can begin implementation of the security logo standard throughout China beyond Beijing and Guangdong. Based on consultations with AQSIQ to date, TPID Beijing projects that the expenses associated with the Beijing/Guangdong Pilot Phase will run approximately 15 million Chinese Yuan or approximately US$2 million. As stated above, the latest gross revenue projections for year one of the AQSIQ contract is 801,800,000 Chinese Yuan or US$106,714,769.20, which includes, but is not limited to, the Beijing/Guangdong Pilot Phase.

Regarding technological implementation for the Beijing/Guangdong Pilot Phase, TPID Beijing will utilize scanners developed by the Company. At the same time, TPID Beijing may supplement the Company's technology with technology from several prominent technology companies in the United States and Europe. TPID Beijing will also utilize its SDNA taggant, which may have to be produced outside China.

Regarding funding to implement the Beijing/Guangdong Pilot Phase and beyond, TPID has met with and received significant interest from several prominent and well-funded entities in China with significant government relationships. These entities are not only interested in funding implementation of the entire AQSIQ Contract but are also interested in using TPID's technologies to help anti-counterfeit their own products and the products of other companies or organizations. TPID has also met with potential funders in and from the U.S., Hong Kong, and other parts of Asia.

*Note that there was an inadvertent error regarding the stated conversion rate in the heading in the gross revenue chart. The conversion rate should read 1 Chinese Yuan = 0.133094 US$1.

About True Product ID

True Product ID produces integrators for anti-counterfeiting and security surveillance applications and is a provider of integrated tracking devices. The Company delivers turnkey solutions for governments, armed forces, and industry, through its own proprietary technology and through aggregating the technology, products, and services of third parties via licensing agreements and or joint ventures. For more information about True Product ID, Inc., go to http://www.tpid.net. For more information about True Product ID Technology (Beijing) Limited, go to http://www.trueproductid.com/.

SAFE HARBOR STATEMENT: This news release contains "forward-looking statements" that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "future," "plan" or "planned," "will" or "should," "expected," "anticipates," "draft," "eventually" or "projected." You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that our products may not achieve customer acceptance or perform as intended, that we may be unable to obtain necessary financing to continue operations and development, and other risks. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements.

Contact:

True Product ID, Inc.

Michael Antonoplos, 610-608-9300

mantonoplos@tpid.net

Source: True Product ID, Inc.

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

Angehängte Grafik:

sc.png

sc.png

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

19-Nov-2007

Change in Directors or Principal Officers, Other Events, Financial Statemen

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

Effective November 15, 2007, the board of directors authorized the new CEO, William R. Dunavant to appoint Wilson W. Hendricks III as the Company's COO. Mr. Hendricks was a past Director, Asia Pacific Region, for KPMG Consulting's Communications and Content practice. The board also authorized Mr. Dunavant to enter into an employment agreement with Mr. Hendricks. A copy of his resume will be available shortly on the Company's website.

The board also authorized, at Mr. Dunavant's request, the division the Office of the President into two separate designations, "China" and "US", so that, effective immediately, Sergio Luz is now the "President-China" of the Company; the "President-US office is vacant.

Item 8.01 Other Events

The Company has reached agreements with three parties that as of November 16, 2007 immediately reduce the Company's total current liabilities by approximately $2,742,000

The three parties agreed to cancel the debt owed them pursuant to various agreements with the Company. These cancellations represent an immediate reduction from the total current liabilities.

The first such agreement was reached with Mr. James MacKay, individually, ("MacKay"). As stated in the November 14, 2007 Form 10-QSB, as of September 30, 2007 Mr. MacKay is owed $462,500 representing all compensation earned by him and expenses owed him since he joined the Company. He has agreed to cancel that amount in full.

The second such agreement was reached with The MacKay Group Limited ("MKG"). As reported in the Company's Form 8-K filed August 17, 2007, according to financial records relating to TPID Beijing,as of August 2007 MKG had advanced approximately US$1 million to or for TPID Beijing and its anti-counterfeiting/product authentication operations. Also, as

reported in the Company's August 17, 2007 Form 8-K, on August 15, 2007, MKG executed a binding term sheet to provide the Company with a line of credit of up to One Hundred Fifty Thousand Dollars (US$150,000) to help fund the initiatives and operations in China and the U.S. The terms and conditions were described in the Company's August 17, 2007 Form 8-K. MKG has agreed to cancel these amounts, approximately $1,150,000, in full.

The third such agreement was reached with Sure Trace Security Corporation ("SSTY"). As stated in the November 14, 2007 Form 10-QSB, as of September 30, 2007, On January 4, 2007, the Company entered into a Restructuring Agreement with Sure Trace Security Corporation. (the "Restructuring Agreement"). Pursuant to the Restructuring Agreement, the Company acquired a 40% ownership interest in the Chinese JV Company, held by SSTY, STA, and Chan.

Under the Restructuring Agreement, the Company agreed, in part:

(i)

To pay SSTY a royalty in the amount of 2% of its gross receipts which the Company actually receives and collects from customers outside China, Hong Kong, and Macau for a period of 2 years commencing as of January 4, 2007 the "Royalty"); and

(ii)

To pay SSTY, on an interest-free basis, within 3 years of the effective date of the Restructuring Agreement $1,130,000, minus the amount of penalties and interest TPID must pay the former control block holder under the Amended Payment Agreement (the "Subject Payment").

In return for the Licensing Rights defined below, SSTY agreed to cancel its rights to receive the Royalty and to cancel in full, the total Subject Payment of $1,130,000 effective immediately.

The Company has agreed to grant SSTY, or its assignee or designee, the exclusive worldwide Licensing Rights in and to any home consumer applications of the Company's anti-counterfeiting and authentication technologies intended for self-application/use by the consumer soley on his/her personal items, including, but not limited to, S-DNA and related technologies that exist and as they may be developed in the future, in all channels of direct response and consumer distribution. Subject to the Company and SSTY reaching mutually acceptable terms in the manner and form to be mutually agreed upon by the parties within 30 days of the date of this letter agreement. SSTY shall also be granted the right to sub-license others to air and/or sell through broadcast and cable television media via telemarketing, direct mail, package inserts, syndication and any other direct response marketing media and via catalogue, internet and related electronic marketing, retail sales and any other means and the non-exclusive right to use the copyrights, trademarks, patents, service marks and trade names in connection with their sales thereof.

Item 9.01. Financial Statements, Pro forma Financial Information and Exhibits.

(c) Exhibits

Exhibits Description

99.1 Employment Agreement Wilson W. Hendricks III

Add TPDI.OB to Portfolio

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

The seminar was attended by leaders and enterprises from Beijing, Shanghai, Guangdong, Hubei, Zhejiang and Liaoning Provinces, all of whom agreed with AQSIQ’s endorsement of TPID’s technology and provided comments on implementation."

__

On May 11, 2007 the Registrant entered into an acquisition agreement (the "Acquisition Agreement") with Sichuan Valencia Trading Limited ("SVTL"), a Chinese limited liability company duly organized under Chinese law. A copy of the Acquisition Agreement is attached hereto as Exhibit 10.1. The reader is advised to review the agreement in its entirety.

Immediately prior to the execution of the Acquisition Agreement, SVTL owned 20% of the total interests, rights, assets, shares, and/or other ownership interests of True Product ID Technology (Beijing) Limited, formerly known as Sure Trace Technology (Beijing) Limited (the "Chinese JV Company"), a Chinese technology limited liability corporation duly formed and organized under Chinese law (the "SVTL 20% Chinese JV Interest"). Under the Acquisition Agreement, SVTL sold to the Registrant the STVL 20% Chinese JV Interest in return for 100 million restricted common shares of the Registrant. As set forth in more detail in the Acquisition Agreement and prior SEC filings, the 100 million shares was less than 50% of the approximately 209 million shares provided as a dividend to shareholders of TPID US' former parent, Sure Trace Security Corporation, which resulted in TPID US' being a separate independent entity entitled to receive approximately 42.5% of the revenues of the Chinese JV Company. With its January 2007 acquisition of 40% of the Chinese JV Company and the acquisition of the SVTL 20% Chinese JV Interest, the Registrant now owns 60% of the total ownership interests of the Chinese JV Company, allowing the Registrant to, among other things, recognize 100% of the revenues of the Chinese JV Company in accordance with applicable consolidation, revenue recognition, accounting, and other principles, guidelines and standards.

Under the Acquisition Agreement, SVTL representative, Sergio da Luz, was appointed to the Registrant's Board of Directors, and SVTL agreed to, inter alia, standard non-competition and confidentiality provisions. See Article III of the attached Acquisition Agreement.

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

Angehängte Grafik:

tpdi.png

tpdi.png

0

--------------------------------------------------

6-Mar-2008

Entry into a Material Definitive Agreement, Change in Directors or Principa

Item 1.01. Entry into a Material Definitive Agreement

On March 4, 2008, we entered into a new Employment Agreement (the "Employment Agreement") with Wilson W. Hendricks, III.

Under the terms of the Employment Agreement, Mr. Hendricks will serve as our chief executive officer ("CEO") for a period of three years. As CEO, Mr. Hendricks will report solely and directly to our Board of Directors. During his term of employment, Mr. Hendricks will earn a base salary of no less than $240,000 per year. In addition to base salary, Mr. Hendricks will be entitled to receive 500,000 restricted shares of the Registrant's common stock immediately upon completion of the Registrant's 100 to 1 reverse split. Mr. Hendricks will also have an opportunity to receive an additional 500,000 restricted shares of the Registrant's common stock at the end of the first year of his contract, based on his performance of certain performance criteria which the Company's Compensation Committee will determine after execution of the contract.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As set forth in the Registrant's Form 8-K filed February 19, 2008, the official Chinese documents known as the "Red Hat" documents have been filed regarding the new joint venture between the Registrant and two organizations affiliated with the State General Administration for Quality Supervision, Inspection and Quarantine of the People's Republic of China ("AQSIQ") to roll out Registrant's Chinese National Gas Tank Contract and Project with AQSIQ.

Given these developments and the impending roll out of Registrant's Chinese National Gas Tank Contract and Project with AQSIQ, on March 4, 2008, the board of directors (the "Board") of the Registrant approved the appointment of the current chief operating officer of the Registrant, Wilson Hendricks III, a past Director, Asia Pacific Region, for KPMG Consulting's Communications and Content Practice, as the Registrant's new chief executive officer ("CEO"). The Board also approved the appointment of Mr. Hendricks as a member of the Registrant's Board.

Prior to joining the Registrant as its chief operating officer in November 2007, Mr. Hendricks was a Director with BearingPoint, Inc. (formerly KPMG Consulting), where he was a member of BearingPoint's Communications and Content practice.

Mr. Hendricks was a founding member of KPMG Consulting's wireless group. As a Director with KPMG Consulting's Asia Pacific Region, Mr. Hendricks was responsible for starting the KPMG Consulting's Asia Pacific Region's communications practice. Mr. Hendricks most recent BearingPoint assignment was as Operations Director for the Department of Homeland Security/Transportation Security Authorities TWIC Program. Mr. Hendricks has extensively resided and worked in China and Hong Kong.

Believing that the Company's interests in the roll-out of its Chinese National Gas Tank Contract with AQSIQ are best served by an international roll-out/implementation expert such as Hendricks now taking over the CEO position of the Registrant, the Registrant's current CEO and

Error! Unknown document

--------------------------------------------------

chairman of the Registrant's board of directors, William R. Dunavant, has voluntarily agreed to step down as CEO and as a director of the Registrant, and will assume the position of Managing Director of Global Strategic Initiatives of the Registrant.

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

0

Optionen

| Antwort einfügen |

| Boardmail an "gindants" |

|

Wertpapier:

Nasdaq 100

|

Angehängte Grafik:

tpdi.png

tpdi.png

Thread abonnieren

Thread abonnieren