|

...In The Same Direction

https://seekingalpha.com/article/...icals-point-in-the-same-direction

Summary- Palantir's fundamentals keep improving, and the stock still trades at an attractive price.

- From a technical standpoint, Palantir's chart looks much better now than a few weeks ago.

- The current price offers a favourable risk/reward entry for both traders and investors.

Thesis Summary After having retraced over 50% from its ATH, Palantir Technologies Inc. (PLTR) has now made a strong reversal, and it looks like a bottom could be in place. Fundamentally, the company remains well-positioned to capitalize on the increased need for security and privacy in data analytics, and profitability should be a non-issue in the long term. Using EWT I forecast a price target north of +$100/share. Fundamental AnalysisPalantir has been both highly acclaimed and criticized by investors since its IPO. The company not only produces division over its value and potential return but also over the effectiveness of its product and even the ethicality of what it does. From a valuation standpoint, bears hold on to the fact that the company isn’t profitable, and probably won’t be due to the reliance on stock-based compensation. I already talked about the latter point in my last article on Palantir. SBC is used to retain their most important asset, people, so I don’t particularly see a problem with this. Furthermore, if we look at the history of other similar companies, there is no reason to believe this should continue to be true. In this section, I’d like to use the profitability of businesses that offer a similar service as a proxy of what Palantir’s profit margins could look like.

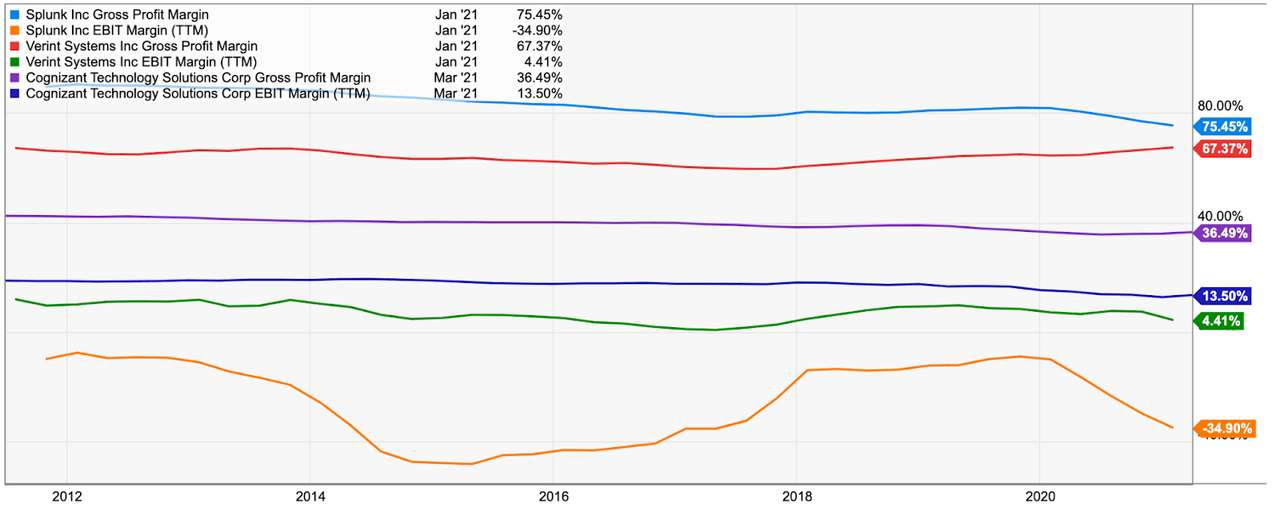

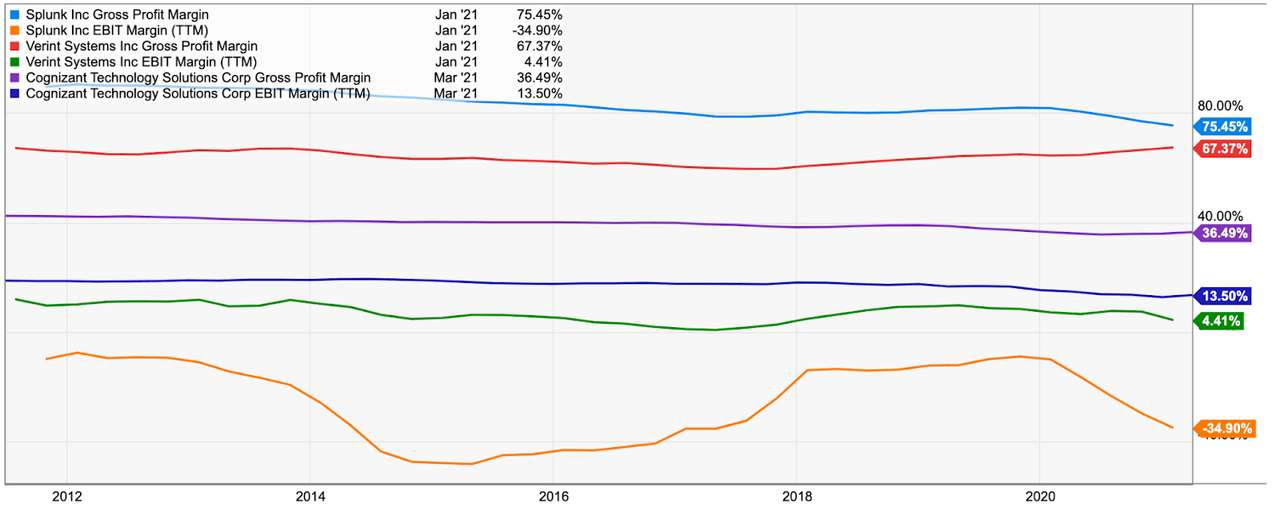

Source: Ycharts What we see above is a comparison of profitability metrics amongst some of Palantir’s “peers”. We have Splunk Inc. (SPLK), Verint Systems Inc. (VRNT), and Cognizant Technology Solutions (CTSH). All of these companies provide similar services. They use their software to handle data and help organizations. They also share the commonality that they all work for the government as well as the private sector. What we can see in the chart above, is that all of these companies, with the exception of Splunk, have been achieving profits in their operations, as seen in the EBIT margin. Even if we take Splunk, which has struggled to deliver positive earnings, it would seem that investors aren’t too concerned, as the stock has appreciated over 500% since its IPO. For the time being, Palantir remains unprofitable, but all the important metrics, such as earnings per customer and deployment times are pointing towards an improvement in profitability. Lastly, as far as growth goes, it’s hard to deny the potential for continued expansion. Palantir continues to add government clients, recently signing a $111M Special Ops contract. With Joe Biden proposing a budget that would take deficits over WWII levels, I don’t think this source of income will dry up any time soon. On the private sector front, Palantir continues to develop new applications for companies, which was shown at Palantir’s Double Click Demo. Technical analysisHaving said this, some bears also point towards the fact that Palantir’s chart doesn't look so good. However, this has changed with the recent rally of the low found in May.

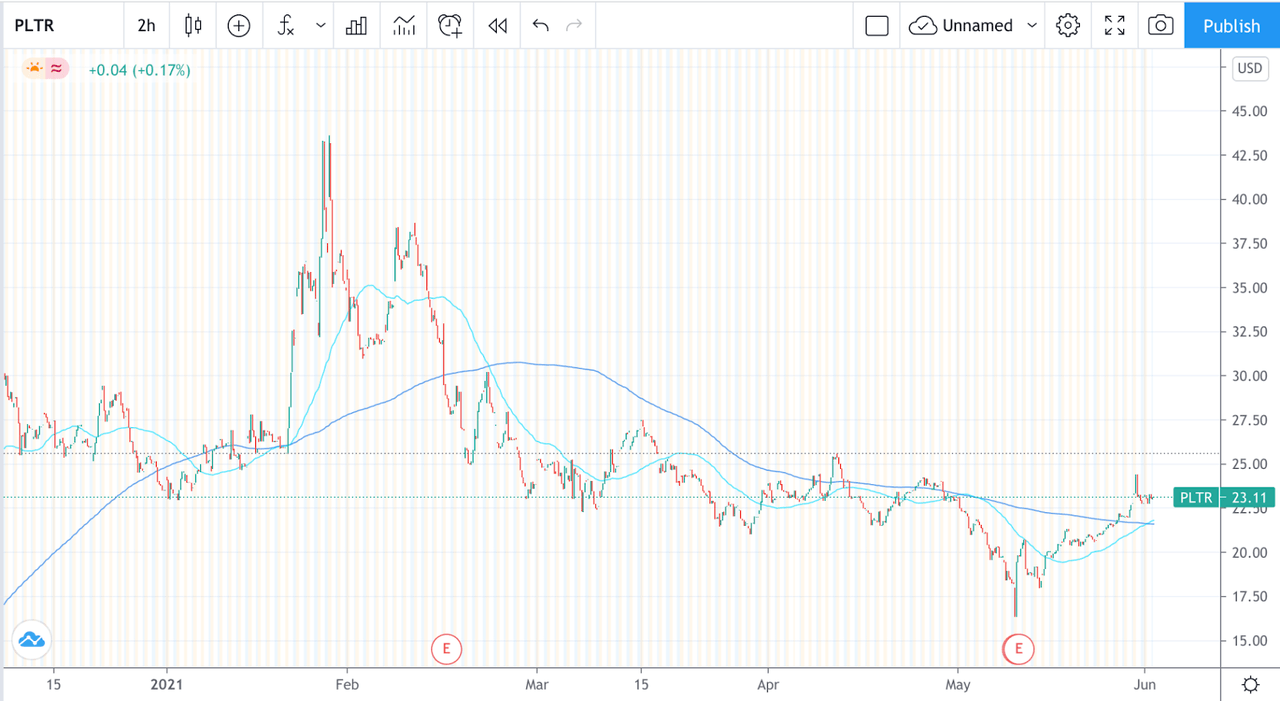

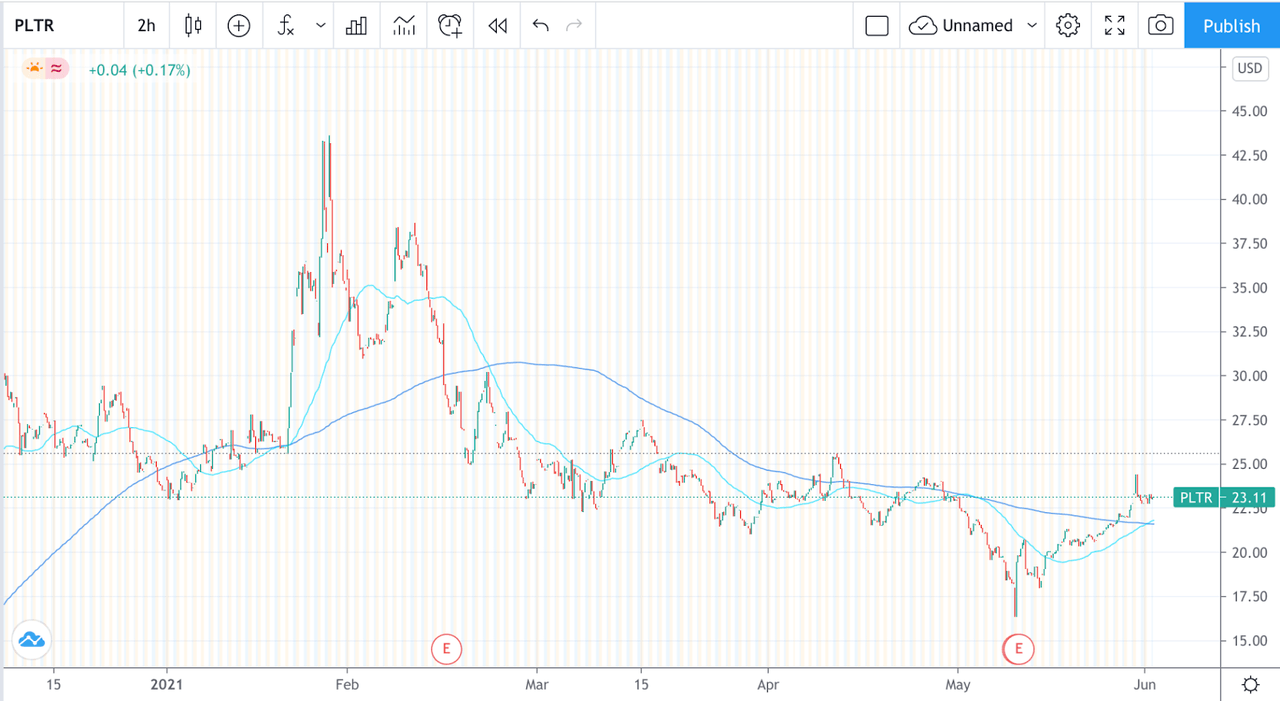

Source: Tradingview Looking at the six-month chart of Palantir, we can appreciate that the 50-day moving average has now crossed the 200-day moving average. The last time this happened, we saw a rally that took the stock to over $45. Of course, moving averages aren’t always 100% correct, but they can give us a good idea of when and where momentum is shifting. So where can we expect Palantir’s stock price to go from here?

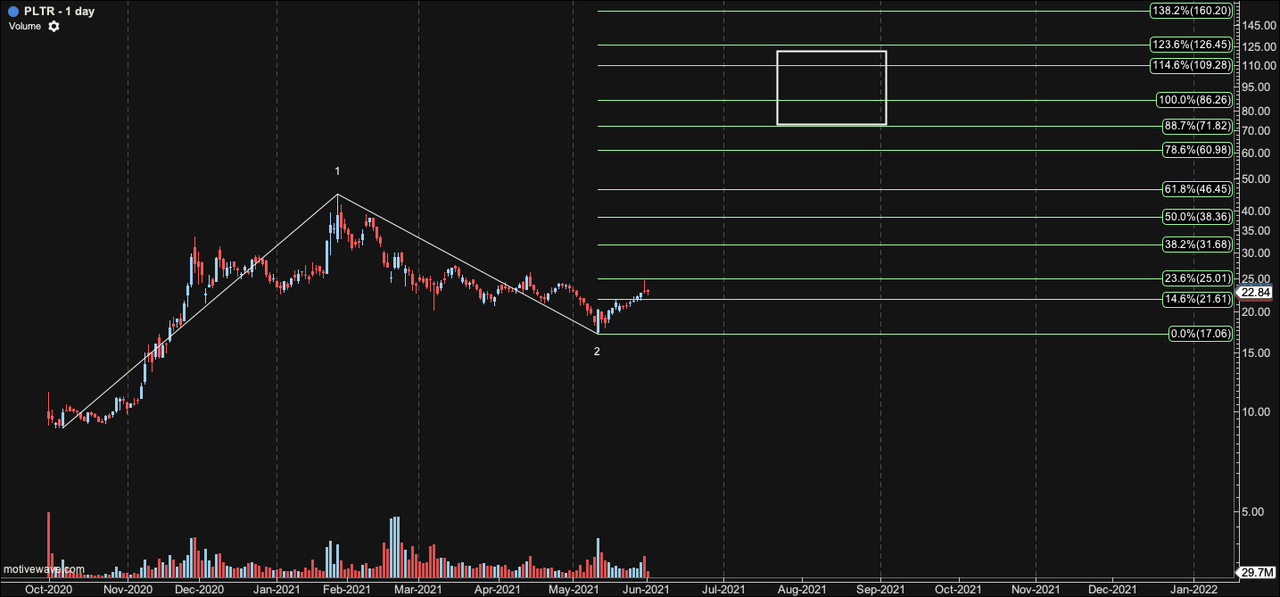

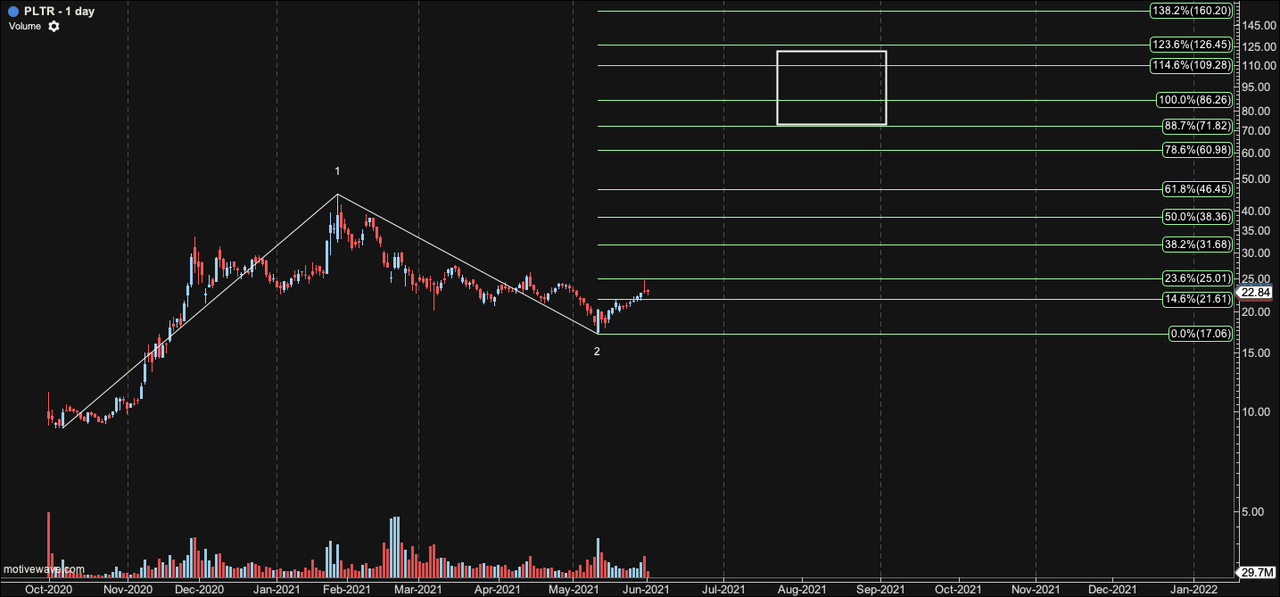

Source: Author’s work Using Elliott Wave Theory, we could say that Palantir is now entering a wave 3, which could protect us all the way up to $86-$126. The actual target will become clearer in the coming months. For now, we still need to get confirmation that a bottom is in. If/when we rally past the recent high of $24, I would be able to count a five-wave structure from the low, which would give us good confirmation that the low is indeed in. As far as a time frame goes, it’s hard to say when we will achieve this given target, but I think 12 months is a reasonable assumption. RisksWhen it comes to Palantir, I believe there is one risk that significantly outweighs all others. For the time being, Palantir still receives most of its revenue from public contracts, so what would happen if the company fell out of favour with the Biden administration or the folks at the army? When push comes to shove, the decision to award (or not) contracts to Palantir comes down to a handful of people, and this is a risk that investors must be wary of. The best defence Palantir has against this, is making itself indispensable, which so far it is doing proficiently. This is shown by the ability Palantir has to retain users and even increase revenue per user. On another note, I do think that profitability at Palantir is far away, which will disappoint some investors. I predict the company will continue to invest aggressively, especially as it tries to make its way into the private sector. TakeawayNo matter which way you look at it, Palantir is now in a much better position than it was weeks and months ago. For starters, it crushed its last earnings report. On top of that, institutional investors are starting to pile into the stock. From a technical point of view, the stock has rallied very convincingly from its May low, and as long as we can hold the $20 area more immediate upside is on the cards. Palantir is not a stock for everyone, but one must at least acknowledge that it has the potential for great returns, and the current setup offers an entry with limited risk.

|

1 |

... |

104 |

105 |

|

107 |

108 |

...

| 314

1 |

... |

104 |

105 |

|

107 |

108 |

...

| 314

Thread abonnieren

Thread abonnieren