Vietnam Opportunities +++

|

Seite 1 von 4

neuester Beitrag: 03.05.07 06:48

|

||||

| eröffnet am: | 20.09.06 10:24 von: | skunk.works | Anzahl Beiträge: | 98 |

| neuester Beitrag: | 03.05.07 06:48 von: | skunk.works | Leser gesamt: | 32353 |

| davon Heute: | 1 | |||

| bewertet mit 16 Sternen |

||||

1 |

2 |

3 |

4

| 4

1 |

2 |

3 |

4

| 4

|

||||

|

--button_text--

interessant

|

|

witzig

|

|

gut analysiert

|

|

informativ

|

16

- Kenne den S/O Asiatischen raum mittelmässig gut, entspricht dem Verlauf einzlner Werte und reproduziert die aufsteigende Vietnamesische Wirtschaft

- Ausser die generellen Fakten zu diesem Wert, der in seine Verhältnissen sehr gut performed, hqt Jemqnd zus¨tzliche Infos (Kayman, etc)

viel Glück allen

Optionen

0

§

The Vietnam Post and Telecom Group (VNPT) has entered into a cooperative deal with Vietnam's third-largest commercial bank to support mutual development.

Under the deal signed Thursday in Hanoi, VNPT and Bank for Development of Vietnam (BIDV) will work together as strategic partners, each reserving a major chunk of shares for the other to purchase on a mutual basis.

The two giant state corporations will utilize services including money transfers through their network of post agents, office transactions, automatic teller machines (ATMs), phone banking and internet banking.

The leading telecoms and banking providers plan to establish fund managers in various fields including energy, telecoms, property and mining.

They will also assist each other in training staff, according to the agreement.

Both sides will act as strategic founding members of fund management companies.

A BIDV representative said the two parties had also discussed either setting up or controlling a major portion of stakes in companies involved in the country’s forthcoming key mega projects.

These comprise the express way connecting the Ho Chi Minh City – Long Thanh – Dau Giay, the Vietnam-Laos Hydropower plant, Vietnam – Cambodia Hydropower plant, and a bank for trade, industry and services of Vietnam.

BIDV and VNPT have long established a close relationship as the bank had used VNPT-sourced services in return for short, medium and long term credit and syndicated loans for telecom projects.

The new formal strategic cooperation with a leading bank will enable VNPT to expand services and develop financial operations with the telecom business.

VNPT, last year, became a member of the ASEAN Telecom Holding Company (ATH/ACASIA), one of the Association of Southeast Asian Nations (ASEAN)'s leading primary network service providers, made up of the six leading telecom providers in the region, namely CAT, Indosat, JTB, PLDT, Singtel and Telekom Malaysia.

Optionen

0

§

Vietnam warned investors on Thursday to steer clear of shares in four banks which have been non-operational for years, and to avoid a grey market in stock of banks that have yet to win a trading license.

Amid talk that one of the four, Viet Hoa, may soon re-open its doors after a run on deposits closed it down in the late 1990s, the central bank moved to protect investors from themselves in the red-hot financial sector.

"Recently the central bank has received much information about trading of shares in banks which have been placed under special surveillance or had their license revoked, and trading the right to buy shares of banks which have not been licensed," the central bank said in a statement.

It named four out of 38 partly private banks which were non-operational as of the end of January as Viet Hoa, Nam Do, Vung Tau and Asia-Pacific banks.

"... trading shares in these banks at this time has not sufficient legal basis", the statement said.

Trading in shares of partly-private banks has been active on Vietnam's unregulated markets after sound results in 2006 and high dividend payments of up to 50 percent in some cases, brokers said.

On the regulated market, Sacombank and Asia Commercial Bank are the only available financial investment, and their surging share prices have helped take the Ho Chi Minh City and Hanoi benchmark indexes to record highs in recent weeks.

The central bank said several organizations and individuals had plans to establish new banks, which it named as Van Phong, Tin Nghia, Lien Viet and the Oil and Gas bank, but it said the central bank has not yet licensed their operation.

The prices of bank shares have also been lifted amid moves by foreign banks to buy stakes, and as five state-run banks have been ordered to conduct initial public offerings this year and in 2008.

Next Monday state-run Bank for Foreign Trade, Vietnam's second-largest bank, will sign a contract to hire global investment bank Credit Suisse to advice on its partial privatization, banking officials said.

Deutsche Bank has been picked to advice state-run Mekong Delta Housing Development Bank for its IPO, State Bank of Vietnam Deputy Governor Phung Khac Ke told Reuters on Tuesday.

The selection of foreign consultants takes communist-run Vietnam further in its reform of the banking sector after it joined the World Trade Organization last month.

Last Thursday, Deutsche Bank said it had agreed to buy 20 percent of stake at an undisclosed value in Hanoi Building Bank, Vietnam's sixth largest partly private commercial bank.

HSBC Holdings Plc. plans to spend $71.5 million to double its stake in Techcombank to 20 percent once it is allowed to do so.

The government is expected to soon double the foreign ownership curb for an individual investor in a local bank to 20 percent.

Citigroup, Standard Chartered , ANZ , Oversea-Chinese Banking Corp. , BNP Paribas and United Overseas Bank also have business interest or hold up to 10 percent of stake in a Vietnamese bank.

Optionen

1

2

1054.26+ 23.36 +2.27%

ABT 137,000§ 6000 4.58% 34,050

AGF 136,000§ 6000 4.62% 16,210

ALT 70,000§0 0.00% 5,650

BBC 51,500§ 2000 4.04% 61,920

BBT 18,400§ 800 4.55% 113,050

BHS 48,500§ 1000 2.11% 37,740

BMC 195,000§ 9000 4.84% 9,290

BMP 238,000§ 11000 4.85% 99,890

BPC 27,900§ 400 1.45% 22,500

BT6 67,000§ 1500 2.29% 15,100

BTC 17,600§ 800 4.76% 21,880

CAN 31,500§0 0.00% 32,650

CII 83,000§0 0.00% 218,460

CLC 50,500§ 1000 2.02% 1,890

COM 66,000§ 3000 4.76% 39,150

CYC 14,900§ -100 -0.67% 19,570

DCT 31,300§ -1200 -3.69% 221,490

DHA 71,000§ 2000 2.90% 40,150

DHG 279,000§ 13000 4.89% 20,590

DIC 37,500§ 1500 4.17% 15,250

DMC 145,000§ 3000 2.11% 14,760

DNP 61,500§ 2500 4.24% 54,670

DPC 45,200§0 0.00% 25,200

DRC 179,000§ 8000 4.68% 40,530

DTT 53,000§ 2500 4.95% 500

DXP 44,400§ 2100 4.96% 7,020

FMC 89,000§ 2000 2.30% 21,260

FPC 52,000§ 2200 4.42% 78,910

FPT 602,000§ 28000 4.88% 60,490

GIL 72,000§ 2000 2.86% 47,030

GMC 58,000§ 2000 3.57% 26,450

GMD 190,000§ 9000 4.97% 177,500

HAP 68,500§ 2000 3.01% 145,450

HAS 72,000§ 3000 4.35% 38,240

HAX 40,900§ 1900 4.87% 2,700

HBC 92,000§ 1500 1.66% 15,450

HBD 28,200§ -1300 -4.41% 2,000

HMC 32,300§ -1600 -4.72% 32,610

HRC 337,000§ 16000 4.98% 31,670

HTV 42,000§ 1600 3.96% 143,020

IFS 39,800§ -200 -0.50% 22,400

IMP 135,000§ 2000 1.50% 32,160

ITA 140,000§ 6000 4.48% 348,860

KDC 214,000§ 10000 4.90% 50,030

KHA 33,600§ 1600 5.00% 110,040

KHP 31,000§ 300 0.98% 125,960

LAF 17,800§ 800 4.71% 163,580

LBM 27,000§ 1200 4.65% 33,190

LGC 63,000§0 0.00% 800

MCP 32,500§ 1500 4.84% 2,210

MCV 44,000§ 1800 4.27% 3,850

MHC 50,500§ 500 1.00% 72,440

NAV 159,000§ 7000 4.61% 10,060

NHC 43,100§ -900 -2.05% 14,030

NKD 169,000§ 4000 2.42% 175,790

NSC 48,000§0 0.00% 19,530

PAC 52,500§ -1500 -2.78% 61,130

PGC 64,000§ 3000 4.92% 119,420

PJT 49,300§ 2300 4.89% 38,460

PMS 29,000§0 0.00% 15,420

PNC 26,000§ 1000 4.00% 112,800

PPC 95,000§ -4500 -4.52% 843,820

PRUBF1 14,000§ 400 2.94% 351,290

PVD 281,000§ 11000 4.07% 262,090

RAL 122,000§ 3000 2.52% 63,120

REE 220,000§ 10000 4.76% 223,090

RHC 56,500§0 0.00% 12,530

SAF 40,400§ 1900 4.94% 4,410

SAM 219,000§ 10000 4.78% 26,190

SAV 64,000§ 500 0.79% 27,150

SCD 48,000§ 500 1.05% 75,220

SDN 43,500§0 0.00% 8,220

SFC 57,500§ 2500 4.55% 14,310

SFI 178,000§ 8000 4.71% 18,460

SFN 42,000§ -2200 -4.98% 16,870

SGC 50,000§0 0.00% 11,600

SGH 79,500§ 3500 4.61% 4,640

SHC 34,500§ -1500 -4.17% 7,950

SJ1 50,000§0 0.00% 12,080

SJD 53,000§ -500 -0.93% 27,000

SJS 362,000§ -19000 -4.99% 41,240

SMC 53,500§ 1500 2.88% 41,980

SSC 90,000§ 4000 4.65% 20,430

STB 99,000§ 2000 2.06% 440,390

TAC 57,500§ 2500 4.55% 14,100

TCR 34,000§0 0.00% 19,780

TCT 69,000§ 3000 4.55% 10,200

TDH 210,000§ 10000 5.00% 64,600

TMC 59,500§ 2500 4.39% 13,870

TMS 67,000§ 1000 1.52% 29,820

TNA 39,500§ 1000 2.60% 1,370

TRI 44,500§ -2100 -4.51% 81,570

TS4 44,300§ -2300 -4.94% 13,480

TTC 19,500§ -900 -4.41% 90,950

TTP 88,000§ 4000 4.76% 15,510

TYA 61,000§ 2500 4.27% 99,150

UNI 46,900§ 1400 3.08% 21,370

VFC 38,000§ 1700 4.68% 20,420

VFMVF1 41,200§ 1200 3.00% 272,920

VGP 50,000§ -500 -0.99% 21,280

VID 50,500§ 1500 3.06% 22,280

VIP 82,000§ 1000 1.23% 15,470

VIS 44,000§ 500 1.15% 8,410

VNM 188,000§ 7000 3.87% 583,280

VPK 22,000§0 0.00% 21,520

VSH 80,500§ 500 0.63% 556,330

VTA 17,800§ -700 -3.78% 8,130

VTB 67,000§0 0.00% 26,720

VTC 60,000§ -3000 -4.76% 23,700

Optionen

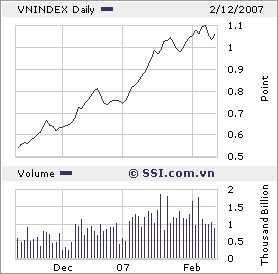

Angehängte Grafik:

DrawChart-1.png

DrawChart-1.png

0

Khối lượng giao dịch Giá trị giao dịch (trđ)

Giao dịch toàn thị trường 7.424.020 100.00% 923.082,3 100.00%

Giao dịch khớp lệnh của cổ phiếu 7.424.020 100,00% 923.082 100,00%

Giao dịch thỏa thuận của cổ phiếu 0 0,00% 0 0,00%

Giao dich thỏa thuận của trái phiếu 0 0,00% 0 0,00%

GIAO DỊCH KHỚP LỆNH TRONG NƯỚC

TT Mã CK KLCP đang niêm yết Giá tham chiếu (1) Đợt 1 Đợt 2 Đợt 3 (3) = (2-1) Tổng lệnh đặt Tổng KL đặt GD khớp lệnh Mức vốn hóa (trđ)

Giá KL Giá KL Giá (2) KL Mua Bán Mua Bán Tổng KL Tổng GT (trđ)

1 ABT 3.300.000 137.000 140.000 10.220 139.000 9.010 139.000 4.800 +2.000 0 0 0 0 24.030 3.350,39 458.700

2 AGF 7.887.578 136.000 140.000 9.300 140.000 23.500 132.000 19.280 -4.000 0 0 0 0 52.080 7.136,96 1.041.160,296

3 ALT 8.747.426 70.000 70.000 1.870 69.500 3.730 70.000 2.150 0 0 0 0 0 7.750 540,635 612.319,82

4 BBC 8.747.426 51.500 54.000 9.600 52.000 20.800 52.000 47.630 +500 0 0 0 0 78.030 4.076,76 454.866,152

5 BBT 6.840.000 18.400 19.300 32.530 19.300 19.220 19.000 27.600 +600 0 0 0 0 79.350 1.523,175 129.960

6 BF1 50.000.000 14.000 14.000 142.000 14.000 84.250 14.000 137.900 0 0 0 0 0 364.150 5.098,1 700.000

7 BHS 16.200.000 48.500 48.500 21.140 48.500 36.590 48.500 14.450 0 0 0 0 0 72.180 3.500,73 785.700

8 BMC 1.311.400 195.000 195.000 0 204.000 3.000 204.000 1.500 +9.000 0 0 0 0 4.500 918 267.525,6

9 BMP 10.718.000 238.000 249.000 24.020 249.000 15.670 249.000 8.030 +11.000 0 0 0 0 47.720 11.882,28 2.668.782

10 BPC 3.800.000 27.900 28.800 3.510 29.000 13.050 29.200 7.680 +1.300 0 0 0 0 24.240 703,794 110.960

11 BT6 10.000.000 67.000 68.000 16.950 67.000 7.190 68.000 19.670 +1.000 0 0 0 0 43.810 2.971,89 680.000

12 BTC 1.261.345 17.600 18.400 3.000 18.400 7.210 18.400 2.550 +800 0 0 0 0 12.760 234,784 23.208,748

13 CAN 3.500.000 31.500 30.500 10.340 31.000 12.470 31.000 8.140 -500 0 0 0 0 30.950 954,28 108.500

14 CII 30.000.000 83.000 87.000 6.810 87.000 26.400 87.000 5.250 +4.000 0 0 0 0 38.460 3.346,02 2.610.000

15 CLC 8.400.000 50.500 51.500 7.910 52.500 11.170 51.000 2.670 +500 0 0 0 0 21.750 1.129,96 428.400

16 COM 3.400.000 66.000 69.000 1.300 67.500 7.660 66.000 3.930 0 0 0 0 0 12.890 866,13 224.400

17 CYC 1.990.530 14.900 15.000 16.040 14.800 1.900 14.900 2.000 0 0 0 0 0 19.940 298,52 29.658,897

18 DCT 12.097.346 31.300 32.500 79.020 32.500 84.830 32.000 50.400 +700 0 0 0 0 214.250 6.937,925 387.115,072

19 DHA 5.005.000 71.000 73.000 51.380 74.500 57.420 74.500 16.790 +3.500 0 0 0 0 125.590 9.279,385 372.872,5

20 DHG 8.000.000 279.000 290.000 400 279.000 900 279.000 300 0 0 0 0 0 1.600 450,8 2.232.000

21 DIC 3.200.000 37.500 39.200 8.280 39.300 2.530 39.300 15.060 +1.800 0 0 0 0 25.870 1.015,863 125.760

22 DMC 10.700.000 145.000 144.000 1.300 141.000 20.000 144.000 4.630 -1.000 0 0 0 0 25.930 3.673,92 1.540.800

23 DNP 2.000.000 61.500 64.500 12.800 64.500 10.800 64.500 9.000 +3.000 0 0 0 0 32.600 2.102,7 129.000

24 DPC 1.587.280 45.200 47.400 9.430 47.400 15.230 47.400 10.740 +2.200 0 0 0 0 35.400 1.677,96 75.237,072

25 DRC 9.247.500 179.000 187.000 27.270 187.000 14.800 185.000 29.960 +6.000 0 0 0 0 72.030 13.409,69 1.710.787,5

26 DTT 2.000.000 53.000 55.500 500 55.500 300 53.000 300 0 0 0 0 0 1.100 60,3 106.000

27 DXP 3.500.000 44.400 46.000 2.770 46.000 2.130 44.400 2.000 0 0 0 0 0 6.900 314,2 155.400

28 FMC 6.000.000 89.000 91.000 4.500 90.000 9.270 90.500 3.550 +1.500 0 0 0 0 17.320 1.565,075 543.000

29 FPC 1.914.611 52.000 54.500 10.200 54.500 4.570 54.500 3.000 +2.500 0 0 0 0 17.770 968,465 104.346,3

30 FPT 60.810.230 602.000 632.000 91.740 620.000 19.130 630.000 49.730 +28.000 0 0 0 0 160.600 101.170,2 38.310.446,16

31 GIL 4.550.000 72.000 75.500 12.690 75.500 23.850 75.500 12.660 +3.500 0 0 0 0 49.200 3.714,6 343.525

32 GMC 2.275.000 58.000 59.500 3.600 59.000 5.300 59.000 2.250 +1.000 0 0 0 0 11.150 659,65 134.225

33 GMD 34.795.315 190.000 190.000 51.300 190.000 47.470 185.000 26.530 -5.000 0 0 0 0 125.300 23.674,35 6.437.133,46

34 HAP 6.000.251 68.500 70.000 26.450 69.000 15.280 69.000 56.300 +500 0 0 0 0 98.030 6.790,52 414.017,319

35 HAS 2.496.730 72.000 75.500 25.060 75.500 22.100 75.500 16.100 +3.500 0 0 0 0 63.260 4.776,13 188.503,115

36 HAX 1.625.730 40.900 42.900 5.100 42.900 2.070 42.900 3.000 +2.000 0 0 0 0 10.170 436,293 69.743,817

37 HBC 5.639.990 92.000 96.500 8.690 96.500 18.010 96.500 16.800 +4.500 0 0 0 0 43.500 4.197,75 544.259,035

38 HBD 1.535.000 28.200 28.200 0 29.500 300 28.500 1.000 +300 0 0 0 0 1.300 37,35 43.747,5

39 HMC 15.800.000 32.300 32.300 0 33.900 100 33.900 5.000 +1.600 0 0 0 0 5.100 172,89 535.620

40 HRC 9.600.000 337.000 344.000 4.910 340.000 3.890 345.000 8.280 +8.000 0 0 0 0 17.080 5.868,24 3.312.000

41 HTV 4.800.000 42.000 40.200 21.800 40.200 14.160 41.000 15.780 -1.000 0 0 0 0 51.740 2.092,572 196.800

42 IFS 5.792.472 39.800 41.000 7.400 40.500 11.520 40.000 9.550 +200 0 0 0 0 28.470 1.151,96 231.698,88

43 IMP 8.400.000 135.000 137.000 8.820 136.000 8.100 137.000 9.630 +2.000 0 0 0 0 26.550 3.629,25 1.150.800

44 ITA 45.000.000 140.000 140.000 61.000 140.000 76.160 140.000 68.590 0 0 0 0 0 205.750 28.805 6.300.000

45 KDC 29.000.980 214.000 224.000 85.100 224.000 30.970 215.000 9.600 +1.000 0 0 0 0 125.670 28.063,68 6.235.210,7

46 KHA 6.537.632 33.600 35.200 50.420 35.200 23.250 35.200 8.700 +1.600 0 0 0 0 82.370 2.899,424 230.124,646

47 KHP 16.322.100 31.000 32.000 69.470 32.500 53.160 32.500 32.970 +1.500 0 0 0 0 155.600 5.022,265 530.468,25

48 LAF 3.819.680 17.800 18.600 42.050 18.600 37.250 18.600 58.960 +800 0 0 0 0 138.260 2.571,636 71.046,048

49 LBM 5.798.901 27.000 27.000 9.260 27.000 800 26.500 7.200 -500 0 0 0 0 17.260 462,42 153.670,877

50 LGC 1.000.000 63.000 63.000 100 66.000 990 66.000 2.520 +3.000 0 0 0 0 3.610 237,96 66.000

51 MCP 3.000.000 32.500 32.500 0 34.100 2.000 34.000 1.600 +1.500 0 0 0 0 3.600 122,6 102.000

52 MCV 3.100.000 44.000 46.000 3.840 46.000 6.250 46.200 2.500 +2.200 0 0 0 0 12.590 579,64 143.220

53 MHC 6.705.640 50.500 51.500 12.480 51.500 30.330 51.000 19.400 +500 0 0 0 0 62.210 3.194,115 341.987,64

54 NAV 2.500.000 159.000 166.000 16.650 166.000 8.700 166.000 700 +7.000 0 0 0 0 26.050 4.324,3 415.000

55 NHC 1.336.061 43.100 45.000 4.490 45.000 100 45.000 2.410 +1.900 0 0 0 0 7.000 315 60.122,745

56 NKD 8.399.997 169.000 170.000 21.000 174.000 102.010 174.000 16.070 +5.000 0 0 0 0 139.080 24.115,92 1.461.599,478

57 NSC 3.000.000 48.000 48.500 7.500 48.500 11.650 48.500 22.120 +500 0 0 0 0 41.270 2.001,595 145.500

58 PAC 10.260.000 52.500 52.500 1.000 52.500 4.040 53.000 2.820 +500 0 0 0 0 7.860 414,06 543.780

59 PGC 20.000.000 64.000 67.000 51.420 66.000 23.750 67.000 27.080 +3.000 0 0 0 0 102.250 6.827 1.340.000

60 PJT 3.500.000 49.300 51.500 8.540 51.500 2.900 51.500 3.500 +2.200 0 0 0 0 14.940 769,41 180.250

61 PMS 3.200.000 29.000 29.000 2.850 29.500 8.200 29.100 1.820 +100 0 0 0 0 12.870 377,512 93.120

62 PNC 3.500.000 26.000 26.500 22.310 26.500 17.600 26.400 22.400 +400 0 0 0 0 62.310 1.648,975 92.400

63 PPC 0 95.000 97.000 78.270 96.000 82.700 96.000 102.870 +1.000 0 0 0 0 263.840 25.406,91 0

64 PVD 68.000.000 281.000 280.000 72.790 280.000 56.440 280.000 47.160 -1.000 0 0 0 0 176.390 49.389,2 19.040.000

65 RAL 7.915.000 122.000 122.000 18.850 123.000 13.150 125.000 30.320 +3.000 0 0 0 0 62.320 7.707,15 989.375

66 REE 28.174.274 220.000 225.000 83.270 225.000 95.390 225.000 78.600 +5.000 0 0 0 0 257.260 57.883,5 6.339.211,65

67 RHC 3.200.000 56.500 59.000 9.460 59.000 3.260 57.000 10.680 +500 0 0 0 0 23.400 1.359,24 182.400

68 SAF 2.706.000 40.400 42.000 580 42.000 2.300 41.200 2.200 +800 0 0 0 0 5.080 211,6 111.487,2

69 SAM 37.439.428 219.000 229.000 35.360 229.000 730 229.000 1.500 +10.000 0 0 0 0 37.590 8.608,109 8.573.629,012

70 SAV 6.500.000 64.000 65.500 8.030 64.000 6.080 64.000 12.450 0 0 0 0 0 26.560 1.711,885 416.000

71 SCD 8.500.000 48.000 50.000 13.630 50.000 4.400 50.000 700 +2.000 0 0 0 0 18.730 936,5 425.000

72 SDN 1.140.000 43.500 43.500 0 43.500 1.880 44.000 2.800 +500 0 0 0 0 4.680 204,98 50.160

73 SFC 1.700.000 57.500 60.000 7.650 58.000 17.000 60.000 7.260 +2.500 0 0 0 0 31.910 1.880,6 102.000

74 SFI 1.138.500 178.000 186.000 12.830 186.000 11.780 186.000 2.270 +8.000 0 0 0 0 26.880 4.999,68 211.761

75 SFN 3.000.000 42.000 42.000 3.000 42.000 6.000 42.000 9.000 0 0 0 0 0 18.000 756 126.000

76 SGC 4.088.700 50.000 50.000 1.300 50.000 3.000 50.000 170 0 0 0 0 0 4.470 223,5 204.435

77 SGH 1.766.300 79.500 81.000 520 83.000 300 83.000 1.450 +3.500 0 0 0 0 2.270 187,37 146.602,9

78 SHC 1.400.000 34.500 34.500 840 35.000 10.900 35.800 3.110 +1.300 0 0 0 0 14.850 521,818 50.120

79 SJ1 2.000.000 50.000 50.000 0 47.900 2.000 48.000 2.300 -2.000 0 0 0 0 4.300 206,2 96.000

80 SJD 20.000.000 53.000 54.500 14.450 54.000 20.420 54.500 12.420 +1.500 0 0 0 0 47.290 2.567,095 1.090.000

81 SJS 5.000.000 362.000 344.000 84.820 344.000 87.830 346.000 234.320 -16.000 0 0 0 0 406.970 140.466,3 1.730.000

82 SMC 6.000.000 53.500 56.000 18.000 56.000 35.310 56.000 11.730 +2.500 0 0 0 0 65.040 3.642,24 336.000

83 SSC 6.000.000 90.000 86.000 18.000 91.000 2.300 94.500 54.110 +4.500 0 0 0 0 74.410 6.870,695 567.000

84 STB 189.947.299 99.000 100.000 261.370 99.500 115.040 99.000 124.730 0 0 0 0 0 501.140 49.931,75 18.804.782,304

85 TAC 18.890.200 57.500 60.000 12.400 60.000 30.210 60.000 10.520 +2.500 0 0 0 0 53.130 3.187,8 1.133.412

86 TCR 4.969.000 34.000 32.300 7.000 32.500 2.940 34.500 15.700 +500 0 0 0 0 25.640 863,3 171.430,5

87 TCT 1.598.500 69.000 70.000 2.220 69.000 4.900 69.000 1.000 0 0 0 0 0 8.120 562,5 110.296,5

88 TDH 17.000.000 210.000 215.000 13.850 218.000 26.620 210.000 2.220 0 0 0 0 0 42.690 9.247,11 3.570.000

89 TMC 2.700.000 59.500 62.000 2.500 62.000 1.000 62.000 6.000 +2.500 0 0 0 0 9.500 589 167.400

90 TMS 4.290.000 67.000 66.000 3.800 66.000 10.290 66.000 20.080 -1.000 0 0 0 0 34.170 2.255,22 283.140

91 TNA 1.300.000 39.500 39.500 1.870 40.000 950 40.000 1.000 +500 0 0 0 0 3.820 151,865 52.000

92 TRI 4.548.360 44.500 46.700 21.760 46.500 24.300 44.500 30.450 0 0 0 0 0 76.510 3.501,167 202.402,02

93 TS4 4.548.360 44.300 45.000 7.730 46.000 3.770 46.000 7.250 +1.700 0 0 0 0 18.750 854,77 209.224,56

94 TTC 4.000.000 19.500 19.500 17.780 19.500 19.300 19.500 12.400 0 0 0 0 0 49.480 964,86 78.000

95 TTP 10.655.000 88.000 92.000 10.460 92.000 40.640 92.000 21.500 +4.000 0 0 0 0 72.600 6.679,2 980.260

96 TYA 4.831.228 61.000 64.000 18.440 61.000 17.910 62.000 30.960 +1.000 0 0 0 0 67.310 4.192,19 299.536,136

97 UNI 1.000.000 46.900 46.000 3.000 48.000 5.750 46.800 1.300 -100 0 0 0 0 10.050 474,84 46.800

98 VF1 50.000.000 41.200 42.200 88.530 42.500 138.790 42.500 188.410 +1.300 0 0 0 0 415.730 17.641,96 2.125.000

99 VFC 5.575.627 38.000 38.000 6.090 38.000 2.500 37.500 3.860 -500 0 0 0 0 12.450 471,17 209.086,013

100 VGP 3.885.020 50.000 48.000 2.300 48.000 9.220 50.000 7.500 0 0 0 0 0 19.020 927,96 194.251

101 VID 8.455.700 50.500 49.000 11.740 50.000 1.500 51.000 17.600 +500 0 0 0 0 30.840 1.547,86 431.240,7

102 VIP 35.100.000 82.000 83.000 22.310 80.000 17.090 81.000 17.280 -1.000 0 0 0 0 56.680 4.618,61 2.843.100

103 VIS 10.000.000 44.000 41.800 510 41.800 2.500 44.000 20 0 0 0 0 0 3.030 126,698 440.000

104 VNM 159.000.000 188.000 197.000 186.860 197.000 241.240 197.000 133.120 +9.000 0 0 0 0 561.220 110.560,3 31.323.000

105 VPK 7.600.000 22.000 22.000 2.000 22.900 1.500 22.500 7.870 +500 0 0 0 0 11.370 255,425 171.000

106 VSH 125.000.000 80.500 84.500 100.460 81.000 87.320 81.000 82.510 +500 0 0 0 0 270.290 22.245,1 10.125.000

107 VTA 4.000.000 17.800 17.800 700 17.000 5.000 17.800 300 0 0 0 0 0 6.000 102,8 71.200

108 VTB 7.000.000 67.000 67.000 5.900 67.000 3.100 70.000 18.130 +3.000 0 0 0 0 27.130 1.872,1 490.000

109 VTC 2.415.000 60.000 57.000 6.130 57.000 24.670 57.000 11.360 -3.000 0 0 0 0 42.160 2.403,12 137.655

Optionen

1

1074.46 +20.2 +1.92%

ABT 139,000§ 2000 1.46% 24,030

AGF 132,000§ -4000 -2.94% 52,080

ALT 70,000§0 0.00% 7,750

BBC 52,000§ 500 0.97% 78,030

BBT 19,000§ 600 3.26% 79,350

BHS 48,500§0 0.00% 72,180

BMC 204,000§ 9000 4.62% 4,500

BMP 249,000§ 11000 4.62% 47,720

BPC 29,200§ 1300 4.66% 24,240

BT6 68,000§ 1000 1.49% 43,810

BTC 18,400§ 800 4.55% 12,760

CAN 31,000§ -500 -1.59% 30,950

CII 87,000§ 4000 4.82% 38,460

CLC 51,000§ 500 0.99% 21,750

COM 66,000§0 0.00% 12,890

CYC 14,900§0 0.00% 19,940

DCT 32,000§ 700 2.24% 214,250

DHA 74,500§ 3500 4.93% 125,590

DHG 279,000§0 0.00% 1,600

DIC 39,300§ 1800 4.80% 25,870

DMC 144,000§ -1000 -0.69% 25,930

DNP 64,500§ 3000 4.88% 32,600

DPC 47,400§ 2200 4.87% 35,400

DRC 185,000§ 6000 3.35% 72,030

DTT 53,000§0 0.00% 1,100

DXP 44,400§0 0.00% 6,900

FMC 90,500§ 1500 1.69% 17,320

FPC 54,500§ 2500 4.81% 17,770

FPT 630,000§ 28000 4.65% 160,600

GIL 75,500§ 3500 4.86% 49,200

GMC 59,000§ 1000 1.72% 11,150

GMD 185,000§ -5000 -2.63% 125,300

HAP 69,000§ 500 0.73% 98,030

HAS 75,500§ 3500 4.86% 63,260

HAX 42,900§ 2000 4.89% 10,170

HBC 96,500§ 4500 4.89% 43,500

HBD 28,500§ 300 1.06% 1,300

HMC 33,900§ 1600 4.95% 5,100

HRC 345,000§ 8000 2.37% 17,080

HTV 41,000§ -1000 -2.38% 51,740

IFS 40,000§ 200 0.50% 28,470

IMP 137,000§ 2000 1.48% 26,550

ITA 140,000§0 0.00% 205,750

KDC 215,000§ 1000 0.47% 125,670

KHA 35,200§ 1600 4.76% 82,370

KHP 32,500§ 1500 4.84% 155,600

LAF 18,600§ 800 4.49% 138,260

LBM 26,500§ -500 -1.85% 17,260

LGC 66,000§ 3000 4.76% 3,610

MCP 34,000§ 1500 4.62% 3,600

MCV 46,200§ 2200 5.00% 12,590

MHC 51,000§ 500 0.99% 62,210

NAV 166,000§ 7000 4.40% 26,050

NHC 45,000§ 1900 4.41% 7,000

NKD 174,000§ 5000 2.96% 139,080

NSC 48,500§ 500 1.04% 41,270

PAC 53,000§ 500 0.95% 7,860

PGC 67,000§ 3000 4.69% 102,250

PJT 51,500§ 2200 4.46% 14,940

PMS 29,100§ 100 0.34% 12,870

PNC 26,400§ 400 1.54% 62,310

PPC 96,000§ 1000 1.05% 263,840

PRUBF1 14,000§0 0.00% 364,150

PVD 280,000§ -1000 -0.36% 176,390

RAL 125,000§ 3000 2.46% 62,320

REE 225,000§ 5000 2.27% 257,260

RHC 57,000§ 500 0.88% 23,400

SAF 41,200§ 800 1.98% 5,080

SAM 229,000§ 10000 4.57% 37,590

SAV 64,000§0 0.00% 26,560

SCD 50,000§ 2000 4.17% 18,730

SDN 44,000§ 500 1.15% 4,680

SFC 60,000§ 2500 4.35% 31,910

SFI 186,000§ 8000 4.49% 26,880

SFN 42,000§0 0.00% 18,000

SGC 50,000§0 0.00% 4,470

SGH 83,000§ 3500 4.40% 2,270

SHC 35,800§ 1300 3.77% 14,850

SJ1 48,000§ -2000 -4.00% 4,300

SJD 54,500§ 1500 2.83% 47,290

SJS 346,000§ -16000 -4.42% 406,970

SMC 56,000§ 2500 4.67% 65,040

SSC 94,500§ 4500 5.00% 74,410

STB 99,000§0 0.00% 501,140

TAC 60,000§ 2500 4.35% 53,130

TCR 34,500§ 500 1.47% 25,640

TCT 69,000§0 0.00% 8,120

TDH 210,000§0 0.00% 42,690

TMC 62,000§ 2500 4.20% 9,500

TMS 66,000§ -1000 -1.49% 34,170

TNA 40,000§ 500 1.27% 3,820

TRI 44,500§0 0.00% 76,510

TS4 46,000§ 1700 3.84% 18,750

TTC 19,500§0 0.00% 49,480

TTP 92,000§ 4000 4.55% 72,600

TYA 62,000§ 1000 1.64% 67,310

UNI 46,800§ -100 -0.21% 10,050

VFC 37,500§ -500 -1.32% 12,450

VFMVF1 42,500§ 1300 3.16% 415,730

VGP 50,000§0 0.00% 19,020

VID 51,000§ 500 0.99% 30,840

VIP 81,000§ -1000 -1.22% 56,680

VIS 44,000§0 0.00% 3,030

VNM 197,000§ 9000 4.79% 561,220

VPK 22,500§ 500 2.27% 11,370

VSH 81,000§ 500 0.62% 270,290

VTA 17,800§0 0.00% 6,000

VTB 70,000§ 3000 4.48% 27,130

VTC 57,000§ -3000 -5.00% 42,160

Optionen

1

AGF 135,000§ 3000 2.27% 51,900

ALT 70,000§0 0.00% 3,660

BBC 53,000§ 1000 1.92% 55,390

BBT 19,000§0 0.00% 81,300

BHS 48,500§0 0.00% 149,490

BMC 214,000§ 10000 4.90% 1,600

BMP 249,000§0 0.00% 36,660

BPC 30,500§ 1300 4.45% 29,180

BT6 68,000§0 0.00% 28,540

BTC 19,300§ 900 4.89% 12,550

CAN 30,800§ -200 -0.65% 35,560

CII 90,000§ 3000 3.45% 70,280

CLC 53,500§ 2500 4.90% 28,620

COM 66,000§0 0.00% 13,600

CYC 15,400§ 500 3.36% 31,290

DCT 33,500§ 1500 4.69% 161,220

DHA 78,000§ 3500 4.70% 109,980

DHG 285,000§ 6000 2.15% 17,160

DIC 41,000§ 1700 4.33% 34,000

DMC 144,000§0 0.00% 10,810

DNP 67,500§ 3000 4.65% 45,660

DPC 48,500§ 1100 2.32% 40,390

DRC 194,000§ 9000 4.86% 63,570

DTT 53,500§ 500 0.94% 3,320

DXP 46,000§ 1600 3.60% 10,450

FMC 90,000§ -500 -0.55% 11,880

FPC 57,000§ 2500 4.59% 8,230

FPT 610,000§ -20000 -3.17% 79,810

GIL 79,000§ 3500 4.64% 46,680

GMC 59,500§ 500 0.85% 8,170

GMD 185,000§0 0.00% 245,060

HAP 70,000§ 1000 1.45% 115,230

HAS 79,000§ 3500 4.64% 65,350

HAX 44,900§ 2000 4.66% 4,050

HBC 96,500§0 0.00% 6,040

HBD 29,800§ 1300 4.56% 3,350

HMC 35,500§ 1600 4.72% 22,160

HRC 362,000§ 17000 4.93% 32,230

HTV 43,000§ 2000 4.88% 59,510

IFS 40,000§0 0.00% 41,300

IMP 140,000§ 3000 2.19% 53,510

ITA 147,000§ 7000 5.00% 238,190

KDC 208,000§ -7000 -3.26% 193,720

KHA 36,900§ 1700 4.83% 32,710

KHP 34,100§ 1600 4.92% 139,580

LAF 19,500§ 900 4.84% 67,820

LBM 25,900§ -600 -2.26% 10,400

LGC 67,000§ 1000 1.52% 1,080

MCP 33,000§ -1000 -2.94% 620

MCV 48,500§ 2300 4.98% 25,310

MHC 50,500§ -500 -0.98% 56,640

NAV 174,000§ 8000 4.82% 35,880

NHC 43,300§ -1700 -3.78% 4,100

NKD 170,000§ -4000 -2.30% 103,010

NSC 50,500§ 2000 4.12% 70,240

PAC 53,000§0 0.00% 19,990

PGC 69,000§ 2000 2.99% 120,430

PJT 54,000§ 2500 4.85% 19,670

PMS 29,000§ -100 -0.34% 24,340

PNC 27,700§ 1300 4.92% 93,910

PPC 95,000§ -1000 -1.04% 288,690

PRUBF1 14,000§0 0.00% 357,280

PVD 280,000§0 0.00% 133,820

RAL 123,000§ -2000 -1.60% 55,280

REE 236,000§ 11000 4.89% 196,600

RHC 59,000§ 2000 3.51% 14,400

SAF 42,000§ 800 1.94% 9,500

SAM 240,000§ 11000 4.80% 97,420

SAV 64,000§0 0.00% 16,870

SCD 52,500§ 2500 5.00% 6,250

SDN 42,300§ -1700 -3.86% 4,300

SFC 60,000§0 0.00% 17,050

SFI 195,000§ 9000 4.84% 32,940

SFN 44,100§ 2100 5.00% 16,460

SGC 50,000§0 0.00% 6,430

SGH 87,000§ 4000 4.82% 1,500

SHC 35,800§0 0.00% 9,200

SJ1 50,000§ 2000 4.17% 5,550

SJD 56,000§ 1500 2.75% 54,210

SJS 363,000§ 17000 4.91% 99,900

SMC 58,500§ 2500 4.46% 65,150

SSC 94,500§0 0.00% 77,280

STB 98,500§ -500 -0.51% 505,450

TAC 60,000§0 0.00% 39,090

TCR 34,000§ -500 -1.45% 16,360

TCT 71,000§ 2000 2.90% 9,080

TDH 215,000§ 5000 2.38% 88,700

TMC 65,000§ 3000 4.84% 25,350

TMS 69,000§ 3000 4.55% 19,990

TNA 42,000§ 2000 5.00% 14,400

TRI 46,600§ 2100 4.72% 66,310

TS4 47,000§ 1000 2.17% 7,150

TTC 20,400§ 900 4.62% 58,500

TTP 94,000§ 2000 2.17% 113,070

TYA 63,000§ 1000 1.61% 82,140

UNI 46,000§ -800 -1.71% 12,230

VFC 38,200§ 700 1.87% 48,360

VFMVF1 42,500§0 0.00% 294,540

VGP 51,000§ 1000 2.00% 21,450

VID 51,000§0 0.00% 34,360

VIP 85,000§ 4000 4.94% 93,780

VIS 44,000§0 0.00% 2,750

VNM 191,000§ -6000 -3.05% 128,220

VPK 23,000§ 500 2.22% 23,330

VSH 81,000§0 0.00% 407,620

VTA 17,800§0 0.00% 3,050

VTB 69,000§ -1000 -1.43% 6,750

VTC 58,000§ 1000 1.75% 11,090

Symbol:

§

News Language:

VNM – Appointed new vice director and establish sub-company

2/13/2007 TTGDCK-HCMC

Trading information dated Feb.13,2007

2/13/2007 SSI

HoSTC- Daily trading summary dated Feb.13,2007

2/13/2007 SSI

DIC – BODs meeting contents

2/13/2007 TTGDCK-HCMC

TMC – Announces the record date to held the annual meeting in 2006

2/13/2007 TTGDCK-HCMC

SFI – Announces the record date to pay dividend and held the annual meeting in 2006

2/13/2007 TTGDCK-HCMC

PVD – Insider trading

2/13/2007 TTGDCK-HCMC

GMD – Insider trading

2/13/2007 TTGDCK-HCMC

VNM – Insider trading

2/13/2007 TTGDCK-HCMC

SSC – Insider trading

2/13/2007 TTGDCK-HCMC

HaSTC - Daily trading summary dated 13 Feb. 2007

2/13/2007 SSI

Trading information dated Feb.12, 2007

2/12/2007 SSI

SFI – Insider trading

2/12/2007 TTGDCK-HCMC

CAN – pay 2nd 2006 dividend and held the shareholders meeting in 2007

2/12/2007 TTGDCK-HCMC

TTP – announces the business performance in 2006.

2/12/2007 TTGDCK-HCMC

Optionen

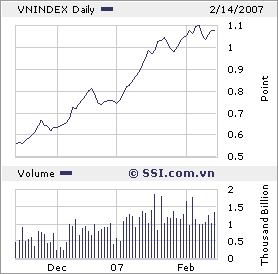

Angehängte Grafik:

DrawChart-1.png

DrawChart-1.png

1

1

Families often spend large amounts of money on food, flowers and firecrackers for Tet. They take to the streets and join crowds setting off firecrackers. These are meant to repel the evil spirit Na A, who is said to be frightened away by noise and bright lights, before the new year begins

Tet is also the time to forgive, cancel debts and put last years problems behind you. Hundreds of people gather in prayer at the Buddhist pagodas, and for a travellers it's a great time to observe the Mahayana Buddhist and Confuscious rituals that are an important part of Vietnamese life

Optionen

Angehängte Grafik:

tet_logo.jpg

tet_logo.jpg

1

Zertifikat über die Bank in CH orderbar..(wenn die Bank ein Akommen hat).

Ein paar Infos dazu 1.tranche Restlos ausverkauft !!!

ML Dynamic Vietnam Basket - in USD und 2. Tranche CHF

* Erste Tranche vom ML Dynamic Vietnam Basket in CHF (Valor 2'891'932) ist ausverkauft

* ML Dynamic Vietnam Basket Zertifikat in CHF II (Valor 2'924'879) - Zeichnungsfrist: 2. März 2007

* ML Dynamic Vietnam Basket Zertifikat in USD (Valor 2'915'834) - Zeichnungsfrist: 23. Februar 2007

* Zertifikate auf den ML Dynamic Vietnam Basket

* Laufzeit 10 Jahre, Emissionspreis CHF 100 / USD 100

* Kotierung an der SWX wird beantragt

http://www.swx.com/download/trading/products/...es/newsletter0406.pdf

Optionen

Angehängte Grafik:

vietnamanim.gif

vietnamanim.gif

0

HA NOI — A consulting agreement signed between Credit Suisse and Vietcombank this week sounds the starting pistol in this year’s race to equitise Viet Nam’s major State-owned banks.

It also marks another milestone in the growth and development of Vietcombank, the nation’s leading bank.

The equitisation of Vietcombank has drawn much attention from the international financial community, and the bank has received many offers from financial institutions in the US, EU, and Asia to co-operate in its equitisation process.

Credit Suisse was ultimately selected as the foreign consultant best suited to shepherd Vietcombank through a rapid course this year.

For an undisclosed amount, Credit Suisse will assist Vietcombank in making its initial public offering (IPO) of shares on the domestic stock market by July, select strategic partners by October, and to make an IPO on an overseas market by next year.

The bank projects to list shares on the HCM Securities Trading Centre, and soon after debuting on the domestic market, Vietcombank will work together with Credit Suisse to decide upon the appropriate overseas market for listing.

The consultant will act as an advisor until Vietcombank completes the international IPO.

The Government will allow Vietcombank to select its own strategic partners, and Credit Suisse, as the foreign consultant during the equitisation process, will not be eligible to become a strategic partner under Vietnamese regulations.

In the end of the IPOs, the State will continue to hold 70 per cent of Vietcombank shares. The bank will issue less than 10 per cent of shares at each IPO. In the IPO on the domestic market, whether or not Vietcombank will allow foreign investors to participate and buy shares is still under review.

Credit Suisse will provide Vietcombank with solutions to convert bonds to shares, management techniques of financial groups, and solutions to deal with bad debts, and risk and asset management.

The success as well as shortcomings in the process of equitisating Vietcombank will provide precious lessons for other State-owned banks lining up to equitise this year, especially Mekong Housing Bank (MHB), Incombank, and the Bank for Investment and Development of Viet Nam (BIDV) all of which are moving quickly to carry out equtisation.

The equitisation process of Vietcombank may differ from that of other banks as it expects to apply strict international criteria to the process. Under its plan to 2015, Vietcombank will strive to become one of the region’s top 70 financial institutions. Vietcombank has been expanding to life insurance and investment fund management sectors with representatives in overseas market.

On February 12, 2007, Vietcombank received a ‘BB/B’ credit ratings from Standard & Poor’s which has also assigned a ‘D’ for the stability of the bank. The credit ratings for Vietcombank were therefore as high as Viet Nam’s sovereign ratings and the highest ratings S&P has granted to a financial institution in Viet Nam.

In 2006, Vietcombank held VND171.86 trillion (US$10.74 billion) in total assets and accounted for 27 per cent of the domestic banking market. The bank also earned VND3.6 trillion ($225 million) in pre-tax profits, up 14.5 per cent year-on-year. — VNS

Optionen

0

1

1117.25-16.09 -1.42%

ABT 140,000§ -4000 -2.78% 19,500

AGF 147,000§0 0.00% 31,890

ALT 92,000§ 2000 2.22% 15,270

BBC 72,500§ 1500 2.11% 156,100

BBT 27,700§ 1300 4.92% 174,430

BHS 63,000§ -500 -0.79% 359,350

BMC 411,000§ -21000 -4.86% 16,210

BMP 212,000§0 0.00% 34,680

BPC 42,500§0 0.00% 41,040

BT6 83,000§ -1000 -1.19% 24,990

BTC 29,400§ 1400 5.00% 23,920

CAN 43,000§ 1000 2.38% 86,680

CII 84,000§ -2000 -2.33% 48,460

CLC 66,000§ 1000 1.54% 49,110

COM 78,000§ -4000 -4.88% 11,540

CYC 27,500§ 500 1.85% 96,220

DCT 50,000§ 1700 3.52% 383,920

DHA 90,500§ -4500 -4.74% 100,220

DHG 275,000§ 13000 4.96% 8,800

DIC 59,500§0 0.00% 26,690

DMC 140,000§ -2000 -1.41% 29,200

DNP 94,500§ -4500 -4.55% 101,110

DPC 53,500§0 0.00% 36,090

DRC 220,000§0 0.00% 80,300

DTT 63,000§ -2000 -3.08% 5,800

DXP 66,500§ 1000 1.53% 14,690

FMC 94,000§ -3000 -3.09% 10,900

FPC 86,000§ -2000 -2.27% 26,690

FPT 562,000§ -16000 -2.77% 100,430

GIL 94,000§ -2500 -2.59% 84,310

GMC 76,500§ -3000 -3.77% 11,600

GMD 175,000§ -6000 -3.31% 81,620

HAP 105,000§ -5000 -4.55% 219,660

HAS 105,000§ -5000 -4.55% 22,420

HAX 53,000§ -2500 -4.50% 7,800

HBC 90,500§ -4500 -4.74% 10,160

HBD 41,500§ 500 1.22% 16,820

HMC 54,500§ 2500 4.81% 60,080

HRC 341,000§ -17000 -4.75% 22,070

HTV 59,500§0 0.00% 31,850

IFS 66,000§ 2000 3.13% 205,150

IMP 143,000§ -2000 -1.38% 30,030

ITA 144,000§ -6000 -4.00% 135,710

KDC 196,000§0 0.00% 59,720

KHA 55,000§ -2500 -4.35% 121,060

KHP 60,000§ 2500 4.35% 221,780

LAF 25,200§ 1100 4.56% 159,090

LBM 37,400§ 1700 4.76% 49,420

LGC 77,500§ 3500 4.73% 7,750

MCP 44,000§ 100 0.23% 11,700

MCV 54,000§0 0.00% 32,410

MHC 63,500§ 3000 4.96% 137,060

NAV 200,000§ -10000 -4.76% 16,860

NHC 63,000§0 0.00% 14,760

NKD 169,000§ -1000 -0.59% 45,910

NSC 80,500§ 3500 4.55% 55,950

PAC 54,000§ -1000 -1.82% 35,510

PGC 80,000§ -500 -0.62% 87,290

PJT 79,000§ -500 -0.63% 62,680

PMS 45,000§0 0.00% 73,230

PNC 38,000§ -2000 -5.00% 29,170

PPC 79,000§ -2000 -2.47% 478,240

PRUBF1 17,900§ -100 -0.56% 1,710,540

PVD 252,000§ -10000 -3.82% 252,180

RAL 132,000§ -5000 -3.65% 67,270

REE 274,000§ -6000 -2.14% 197,910

RHC 70,000§ 3000 4.48% 34,420

SAF 58,500§ 2500 4.46% 22,150

SAM 217,000§ -8000 -3.56% 85,320

SAV 80,000§ -4000 -4.76% 34,340

SCD 77,000§ -4000 -4.94% 14,220

SDN 59,500§0 0.00% 8,210

SFC 103,000§ 4000 4.04% 40,940

SFI 197,000§0 0.00% 17,740

SFN 55,000§ 1500 2.80% 22,260

SGC 61,500§0 0.00% 38,070

SGH 92,000§ 4000 4.55% 7,010

SHC 47,000§ 1100 2.40% 91,530

SJ1 60,000§ 2000 3.45% 10,310

SJD 68,000§ -1500 -2.16% 55,840

SJS 350,000§ -15000 -4.11% 113,460

SMC 74,500§ -3500 -4.49% 86,870

SSC 122,000§0 0.00% 85,280

STB 161,000§ 7000 4.55% 342,780

TAC 70,000§ -2000 -2.78% 90,040

TCR 42,000§ -1000 -2.33% 107,360

TCT 89,000§ -3000 -3.26% 11,020

TDH 208,000§0 0.00% 58,420

TMC 77,000§ -1000 -1.28% 5,100

TMS 81,500§ -2500 -2.98% 31,620

TNA 60,000§0 0.00% 14,020

TRI 57,000§ 500 0.88% 89,130

TS4 59,500§ 2500 4.39% 90,890

TTC 35,000§ 1600 4.79% 69,650

TTP 117,000§ 4000 3.54% 108,270

TYA 61,500§ -2500 -3.91% 63,220

UNI 59,000§ 2500 4.42% 20,920

VFC 57,000§ -2500 -4.20% 18,760

VFMVF1 47,000§ -2000 -4.08% 693,950

VGP 70,000§ 2500 3.70% 43,470

VID 75,000§ -2000 -2.60% 198,070

VIP 109,000§ 2000 1.87% 127,090

VIS 64,000§ 2500 4.07% 25,370

VNM 187,000§ -5000 -2.60% 204,210

VPK 44,000§ 1800 4.27% 121,310

VSH 77,000§ -2500 -3.14% 192,180

VTA 34,600§ 1600 4.85% 94,830

VTB 80,000§ -1000 -1.23% 10,180

VTC 66,000§ 3000 4.76% 17,370

Optionen

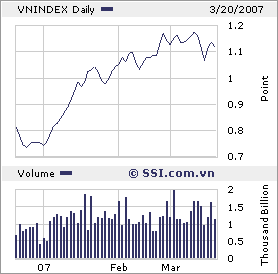

Angehängte Grafik:

DrawChart.png

DrawChart.png

1

Vietnam's economy grew 7.7% year-on-year in the first quarter of this year, which is below the government's target of 8.0% for the quarter, but the strongest first-quarter growth rate since 2001 and above the 7.2% rise in the same quarter by 2006. Vietnam also reported its industrial output in the first quarter rose 16.6% to US$8.1 billion, buoyed by a 29.8% jump in car and truck assembly and a 21% rise in motorcycle production.

Optionen

0

0

06-APR-2007 Intellasia | Ministry of Finance

Apr 6, 2007 - 7:00:04 AM

§

A conference on listing on international stock markets was held by Hanoi Securities Trading Centre (HASTC) and the Singaporean Exchange Ltd (SGX) on April 2.

The conference is part of the framework agreement on connecting the two country’s economies which was signed in December 2005 to help Vietnamese companies to list on international stock exchanges.

Singaporean participants included the trade minister, representatives of SGX and stock market experts and the Vietnamese participants included the finance minister Vu Van Ninh, representatives of the State Securities Commission of Vietnam (SSC), representatives of HASTC, and listed companies and brokers.

At the conference, participants concentrated on the overview of Vietnam and Singapore’s stock markets, especially on which way Vietnamese businesses could meet standards on listing on the SGX. After the conference, SGX said it would hold meetings with Vietnamese businesses that are considering an IPO to consult on what is required.

Optionen

0

AGF 127,000§ 1000 0.79% 6,780

ALT 82,000§0 0.00% 2,690

BBC 61,000§ -1000 -1.61% 15,320

BBT 23,800§ -100 -0.42% 28,450

BHS 52,000§0 0.00% 90,560

BMC 500,000§ 21000 4.38% 13,460

BMP 198,000§0 0.00% 10,210

BPC 34,500§ 500 1.47% 16,320

BT6 69,000§ -2000 -2.82% 11,860

BTC 23,500§ -200 -0.84% 4,000

CAN 34,200§ 200 0.59% 9,100

CII 70,000§0 0.00% 38,060

CLC 50,500§ -2500 -4.72% 4,800

COM 73,500§0 0.00% 23,930

CYC 19,500§ -500 -2.50% 28,010

DCT 38,000§ -800 -2.06% 66,110

DHA 77,000§ 1500 1.99% 35,580

DHG 258,000§ -1000 -0.39% 4,870

DIC 42,300§ -2200 -4.94% 5,630

DMC 125,000§0 0.00% 62,670

DNP 77,000§ 2000 2.67% 20,950

DPC 40,000§0 0.00% 9,990

DRC 201,000§ 9000 4.69% 45,140

DTT 55,000§ -500 -0.90% 2,340

DXP 63,000§ 3000 5.00% 13,300

FMC 82,000§ 1000 1.23% 11,050

FPC 65,500§ -2500 -3.68% 11,080

FPT 515,000§ 5000 0.98% 48,570

GIL 75,000§ -500 -0.66% 25,180

GMC 65,000§0 0.00% 4,160

GMD 166,000§ 1000 0.61% 151,040

HAP 82,000§0 0.00% 85,850

HAS 85,000§ -500 -0.58% 13,780

HAX 49,000§ -1000 -2.00% 1,430

HBC 87,000§0 0.00% 4,470

HBD 37,000§ -1500 -3.90% 2,970

HMC 47,500§ -1000 -2.06% 7,450

HRC 231,000§ -9000 -3.75% 24,800

HTV 46,200§ 2200 5.00% 11,930

IFS 45,000§ -1900 -4.05% 27,490

IMP 127,000§0 0.00% 6,250

ITA 141,000§ -1000 -0.70% 87,560

KDC 199,000§ 6000 3.11% 38,390

KHA 41,000§ 1000 2.50% 60,520

KHP 44,500§ -1500 -3.26% 29,980

LAF 22,500§ -400 -1.75% 23,120

LBM 28,500§ -1500 -5.00% 7,760

LGC 74,500§ -1000 -1.32% 3,730

MCP 37,000§ 900 2.49% 4,040

MCV 43,100§ -900 -2.05% 4,430

MHC 51,000§ -1000 -1.92% 37,870

NAV 185,000§ 3000 1.65% 5,880

NHC 48,000§0 0.00% 1,450

NKD 150,000§ -22000 -12.79% 62,660

NSC 67,000§ -1000 -1.47% 16,320

PAC 47,600§ -400 -0.83% 8,900

PGC 66,500§ 1500 2.31% 37,520

PJT 50,000§ -2500 -4.76% 28,320

PMS 35,800§ -700 -1.92% 8,310

PNC 31,000§ -1000 -3.13% 10,830

PPC 72,000§ 1500 2.13% 189,930

PRUBF1 14,700§ -100 -0.68% 538,630

PVD 261,000§ 12000 4.82% 142,530

RAL 127,000§ -1000 -0.78% 7,410

REE 258,000§0 0.00% 182,810

RHC 56,500§0 0.00% 1,710

SAF 46,000§0 0.00% 6,400

SAM 200,000§0 0.00% 32,030

SAV 68,000§ -2000 -2.86% 19,430

SCD 56,500§ -2500 -4.24% 17,600

SDN 43,000§ -1500 -3.37% 2,010

SFC 78,000§ -2000 -2.50% 24,420

SFI 169,000§ -1000 -0.59% 4,080

SFN 44,700§0 0.00% 3,460

SGC 51,000§ -2000 -3.77% 1,910

SGH 87,000§ 1000 1.16% 1,250

SHC 37,000§0 0.00% 7,200

SJ1 48,000§ -2000 -4.00% 6,030

SJD 55,000§ -500 -0.90% 24,610

SJS 356,000§ 2000 0.56% 34,290

SMC 62,500§0 0.00% 20,230

SSC 115,000§ 1000 0.88% 16,750

STB 147,000§ 2000 1.38% 373,760

TAC 61,000§ -500 -0.81% 23,470

TCR 34,000§ -500 -1.45% 15,070

TCT 88,500§ -1500 -1.67% 2,770

TDH 208,000§ 3000 1.46% 41,890

TMC 65,000§ -1500 -2.26% 2,560

TMS 66,500§0 0.00% 7,600

TNA 43,000§ -2000 -4.44% 11,820

TRI 52,000§ -500 -0.95% 11,670

TS4 54,500§ -1500 -2.68% 3,220

TTC 27,600§ -1400 -4.83% 15,600

TTP 107,000§0 0.00% 31,340

TYA 53,000§ -2000 -3.64% 18,840

UNI 51,000§ -1000 -1.92% 4,590

VFC 42,300§ 300 0.71% 8,800

VFMVF1 35,600§ -200 -0.56% 260,870

VGP 55,500§ -2500 -4.31% 16,210

VID 63,000§0 0.00% 16,790

VIP 91,500§ 2500 2.81% 30,410

VIS 58,000§0 0.00% 4,460

VNM 179,000§ -1000 -0.56% 21,600

VPK 32,100§ -1600 -4.75% 20,510

VSH 70,000§ -2000 -2.78% 32,060

VTA 30,500§ -1400 -4.39% 10,250

VTB 66,000§ -2000 -2.94% 2,750

VTC 54,500§ -2500 -4.39% 2,600

Optionen

1

konkurs sollte ausgeschlossen sein (nebenbedingung)

gruss

Optionen

| Antwort einfügen |

| Boardmail an "asdf" |

|

Wertpapier:

Vietnam Opportunity

|

1

momentan kannst Du ausser Viet Bank keine Einzelaktien kaufen, wird aber kommen...

Konkurs ausgeschlossen...;-) ?

Alles andere sind verschiedene Aktientöpfe Fonds (s a.thread VIETNAM - Good Morning Vi.; bzw den Anfang dieses threads und den Vergleich/Entwicklung unter dem offenen Depot "GGodd Morning Vietnam" unter skunk works..

viel Glück

sw

Optionen

0

1

937.46 +1.98 +0.21%

ABT 98,000§ 3000 3.16% 8,190

AGF 110,000§ 1000 0.92% 2,580

ALT 90,000§0 0.00% 2,020

BBC 54,000§ 2500 4.85% 52,850

BBT 20,000§0 0.00% 13,310

BHS 45,000§ 200 0.45% 43,020

BMC 513,000§ 1000 0.20% 27,760

BMP 171,000§ 8000 4.91% 33,380

BPC 30,500§0 0.00% 7,120

BT6 62,000§0 0.00% 11,400

BTC 21,400§ -1100 -4.89% 2,550

CAN 29,000§0 0.00% 11,010

CII 68,000§ 3000 4.62% 247,400

CLC 51,000§0 0.00% 29,520

COM 65,000§ -1000 -1.52% 8,740

CYC 16,700§ -300 -1.76% 7,770

DCT 31,000§0 0.00% 46,100

DHA 70,000§ -1000 -1.41% 7,400

DHG 245,000§ 10000 4.26% 3,650

DIC 37,000§0 0.00% 4,510

DMC 96,000§ -4000 -4.00% 24,750

DNP 64,000§0 0.00% 15,080

DPC 30,000§0 0.00% 9,340

DRC 137,000§ -53000 -27.89% 68,610

DTT 48,000§ -1000 -2.04% 200

DXP 52,500§0 0.00% 240

FMC 74,000§0 0.00% 1,860

FPC 61,000§ 1000 1.67% 18,450

FPT 442,000§ 9000 2.08% 152,480

GIL 62,000§ -2000 -3.13% 14,900

GMC 54,500§ 1500 2.83% 4,020

GMD 159,000§0 0.00% 157,170

HAP 61,500§0 0.00% 31,170

HAS 74,000§ -1000 -1.33% 10,690

HAX 41,000§0 0.00% 10

HBC 82,000§ 3500 4.46% 8,850

HBD 32,100§ -900 -2.73% 2,910

HMC 38,000§ 1000 2.70% 4,950

HRC 175,000§ 4000 2.34% 31,640

HTV 35,000§ -1500 -4.11% 6,730

IFS 43,500§ -900 -2.03% 11,290

IMP 101,000§ -1000 -0.98% 9,820

ITA 132,000§0 0.00% 115,610

KDC 158,000§ -23000 -12.71% 87,020

KHA 32,400§ -400 -1.22% 23,400

KHP 39,000§ 800 2.09% 17,720

LAF 17,700§ -900 -4.84% 32,920

LBM 27,000§ -500 -1.82% 2,820

LGC 77,000§ -1000 -1.28% 310

MCP 32,500§0 0.00% 4,690

MCV 38,300§ -700 -1.79% 4,490

MHC 44,000§0 0.00% 17,900

NAV 162,000§0 0.00% 7,850

NHC 40,000§0 0.00% 1,020

NKD 130,000§ 2000 1.56% 12,970

NSC 53,000§ 500 0.95% 10,360

PAC 42,000§ -1500 -3.45% 13,870

PGC 56,000§ 1000 1.82% 26,360

PJT 44,000§ -100 -0.23% 7,740

PMS 31,500§ -500 -1.56% 5,950

PNC 27,100§ -900 -3.21% 5,930

PPC 65,000§ -1000 -1.52% 133,430

PRUBF1 13,800§ -200 -1.43% 143,690

PVD 201,000§ 1000 0.50% 119,420

RAL 126,000§ -4000 -3.08% 9,470

REE 234,000§ -1000 -0.43% 357,560

RHC 50,000§0 0.00% 4,350

SAF 36,000§ 400 1.12% 1,450

SAM 195,000§ 1000 0.52% 35,200

SAV 68,000§ 1000 1.49% 11,250

SCD 46,900§ -100 -0.21% 4,180

SDN 40,000§ 1200 3.09% 20

SFC 70,000§ 500 0.72% 10,320

SFI 170,000§ -2000 -1.16% 2,380

SFN 38,000§ 900 2.43% 1,280

SGC 46,000§0 0.00% 650

SGH 84,000§ 4000 5.00% 5,220

SHC 31,100§ -900 -2.81% 2,180

SJ1 42,000§0 0.00% 4,200

SJD 51,000§0 0.00% 28,580

SJS 268,000§ 8000 3.08% 56,480

SMC 50,500§ -10000 -16.53% 16,580

SSC 107,000§ -1000 -0.93% 8,460

STB 138,000§ -1000 -0.72% 216,950

TAC 53,000§ -2000 -3.64% 2,080

TCR 35,000§0 0.00% 39,130

TCT 113,000§ 5000 4.63% 1,900

TDH 195,000§ -5000 -2.50% 34,270

TMC 55,500§ 1000 1.83% 8,350

TMS 63,000§0 0.00% 4,050

TNA 38,000§ -1500 -3.80% 8,180

TRI 51,000§ 2000 4.08% 20,550

TS4 50,500§ 2300 4.77% 6,660

TTC 22,000§ -800 -3.51% 14,700

TTP 86,000§ -3000 -3.37% 14,980

TYA 42,000§ -1000 -2.33% 9,570

UNI 47,000§ -1000 -2.08% 3,910

VFC 35,000§ -1200 -3.31% 8,420

VFMVF1 32,300§ -1700 -5.00% 430,650

VGP 42,000§0 0.00% 5,930

VID 56,500§ -500 -0.88% 12,680

VIP 82,000§ -1000 -1.20% 29,430

VIS 49,500§ -2500 -4.81% 500

VNM 176,000§0 0.00% 260,700

VPK 28,800§0 0.00% 11,460

VSH 62,500§ -2000 -3.10% 107,660

VTA 24,800§ -1100 -4.25% 8,480

VTB 61,000§0 0.00% 840

VTC 41,900§ -1100 -2.56% 6,400

Optionen

Angehängte Grafik:

genetically_modified_rats.gif

genetically_modified_rats.gif

Thread abonnieren

Thread abonnieren