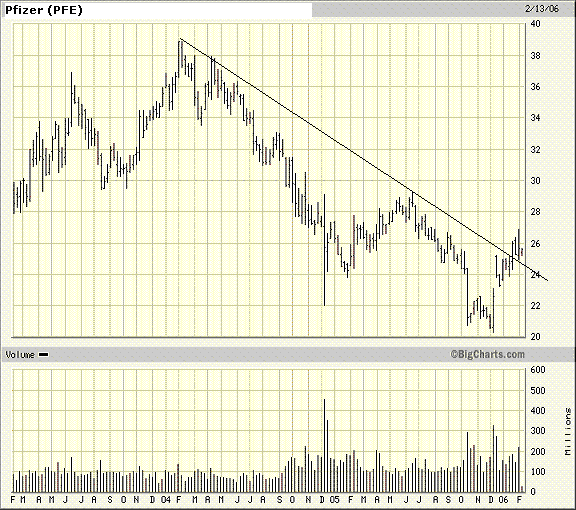

Unten zwei Analysen von Pfizer, beide von Kommentatoren von "theStreet.com". Die Diskussion spiegelt einige hier im Forum gelaufene Querelen wider: Jim Cramer geht fundamental ran und ist eher skeptisch, weil er die Gewinnsituation für (zu) schwächlich und das Management für nicht sehr fähig hält. Charttechnikerin Helene Meisler verweist auf die erfolgreiche Bodenbildung, sieht einen zähen Widerstand bei 26 USD und meint, die Aktie wäre bei Rücksetzern auf 24 USD auf lange Sicht ein gutes Investment.

Ich finde beide Argumente "haben etwas". Ich schätze, die Aktie wird noch eine ganze Weile seitwärts im Trendkanal zwischen 24 und 26 USD laufen. Eine gute Strategie wäre, die Aktie jeweils bei Rücksetzern um 24 zu kaufen und dann jedesmal am Widerstand von 26 zu verkaufen. Wenn man das drei Mal gemacht hat, sind 3 x 2 = 6 Dollar Kursplus im Kasten, dazu die nette Dividende. Das dürfte schneller verdientes Geld sein als zu warten, bis die Aktie von sich aus 6 Dollar nordwärts geht.

Investing

360 Degrees of Pfizer

By TheStreet.com Staff

2/16/2006 1:07 PM EST

Editor's Note: TheStreet.com has always believed that offering a wide variety of opinions and viewpoints -- rather than a monolithic "house view" -- helps readers make better-informed investment decisions. In that spirit, we bring you "360 Degrees."

This weekly feature is designed to take advantage of our stable of reporters and contributors, who will offer analysis of specific stocks from all angles -- fundamental vs. technical vs. short-term trader and long-term investor.

Today's subject, Pfizer (PFE:NYSE) , was chosen by the readers last week; please see our poll below to help determine the next stock to get the "360 Degrees" treatment.

Cramer's Take: Not Too Big to Sell

Pfizer is a value trap. It's making the same amount per share that it thought it would make two years ago. Worse, it has no recognition that it has become a lesser-run pharma, especially compared to Glaxo (GSK:NYSE ADR) , Sanofi-Aventis (SNY:NYSE ADR) and Novartis (NVS:NYSE ADR). I think that current management is badly overrated. It is too big to be taken over and too unwieldy to pare down, despite the opportunity to sell some consumer products.

I vastly prefer Schering-Plough (SGP:NYSE) because of its small base and its management, which is hungry and lean. The only drug companies that I think are worse than Pfizer are Bristol-Myers (BMY:NYSE) , because of its patent litigation, and Merck (MRK:NYSE) , because of the lawsuits from its antipain drug Vioxx.

I would avoid it at all costs, and do not by any means be tempted by that dividend, which I think is too high, given the company's prospects.

Jim Cramer is a director and co-founder of TheStreet.com. He contributes daily market commentary for TheStreet.com's sites and serves as an adviser to the company's CEO.

At the time of publication Cramer's charitable trust was long Schering-Plough.

The Chartist: Building a Base

Pfizer's first step in making a bottom was that explosive move off the lows on volume. The next step was crossing that downtrend line.

I've chosen to use a longer-term, weekly chart to illustrate Pfizer's process of making a bottom. It has run into its first resistance at that $26 area. Any move back to the $24 area ought to hold and make the stock buyable.

Pfizer has many layers of resistance as it goes up, but it appears it has seen its low and is now in the process of building a better base from which to emerge. It will likely take several more months for Pfizer to complete its base, but it is on its way and would make a good longer-term investment.

|

Angehängte Grafik:

30791.bmp

1 |

... |

81 |

82 |

83 |

|

85 |

86 |

87 |

...

| 198

1 |

... |

81 |

82 |

83 |

|

85 |

86 |

87 |

...

| 198

Thread abonnieren

Thread abonnieren