Unten ein hochinteressanter Artikel von Bloomberg (Mod: leicht gekürzt!), zu dem ich mal eine erweiterte Zusammenfassung auf Deutsch geschrieben habe (auch für die, die nicht genug Englischkenntnisse haben).

PE-Deals, die nicht aufgehen. Ein Beispiel von fünf aktuellen:

Goldman-Sachs, Lehman, Citygroup und Wachovia wurden vom PE-Fond KKR mit der Finanzierung der PE-Übernahme der bislang börsennotierten US-Firma "Dollar General" beauftragt. Dazu wurde zwischen diesen Prime Brokern und KKR ein Finanzierungsvertrag geschlossen. Üblicherweise legen die Prime-Broker nun ein (Junk-)Bondpaket der zu übernehmenden Firma - hier Dollar General - auf, das sie dann an beliebige Interessenten (z. B. Hedgefonds) weiter verkaufen, um so das Geld für die PE-Übernahme zu besorgen.

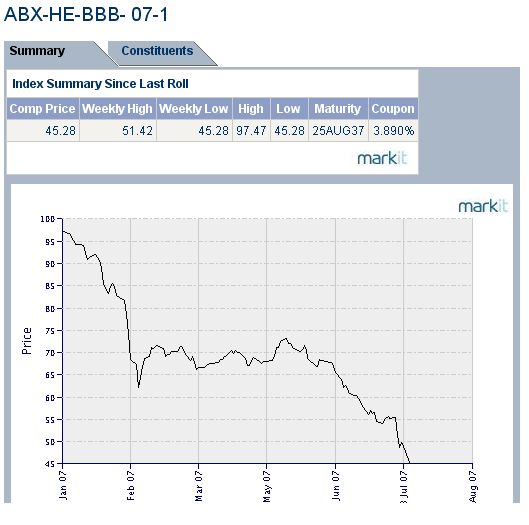

Das klappte bis jetzt auch immer prima. Doch nach der Bear-Stearns-Hedgefond-Krise, die auch den ABX-Junkbond-Chart (unten) abstürzen ließ, sind die "Investoren", die sich bislang um solche Bonds geradezu rissen, misstrauisch und risikoscheu geworden. Die vier Prime Broker konnten deshalb nicht genügend Käufer für das aufgelegte Junkbond-Paket finden. Daher waren sie gezwungen, zur Erfüllung des Vertrags mit KKR einen Teil dieser Bonds - im Gegenwert von 725 Millionen Dollar - aus eigener Tasche zu kaufen.

(Junk-)Bonds befinden sich aber zurzeit in USA im freien Fall, so dass der Wert dieser Bonds (ursprünglich 725 Millionen) seit ihrem Kauf am 28. Juni um bislang 43,5 Millionen Dollar gefallen ist. Und ein Ende des Preisverfalls ist noch längst nicht abzusehen. Die vier Prime Broker müssen die Verluste nun selber tragen und in ihren Bilanzen ausweisen, während sie solche Probleme bislang immer bequem auf externe Hedgefonds abwälzen konnten, die sie bei Bedarf auch skrupellos in die Pleite schickten.

Klar hätten die vier Prime Broker diese Hochrisiko-Bonds lieber nicht gekauft. Aber die PE-Bosse sind toughe "Verhandler". Sie bestehen knallhart auf Vertragserfüllung, wenn die Prime Broker die Finanzierung eines PE-Deals vertraglich zugesichert haben. Dies sei halt das "unternehmerische Risiko" der Prime Broker, die für ihre Dienstleistungen im Gegenzug ja auch saftige Gebühren verlangen.

Früher enthielten solche Verträge häufig Rücktrittsklauseln, die es den Prime Brokern erlaubten, vom Vertrag zurückzutreten, wenn die Bond-Emission keine Käufer fand. Doch in ihrer Gier um neue PE-Aufträge überboten sich die fünf großen US-Broker in letzter Zeit wechselseitig - und räumten immer großzügigere Konditionen ein: Nur drei von 40 laufenden Verträgen enthalten eine solche Rücktrittsklausel.

Dies ist nur eins von fünf Beispielen aus den letzten Wochen.

Insgesamt sitzen US-Prime Broker zurzeit auf unverkäuflichen Junk-Bonds zur PE-Finanzierung im Gegenwert von 11 Milliarden Dollar! Und dabei stehen noch Deals im Wert von schätzungsweise 290 Milliarden Dollar aus. Das ist definitiv der Todesstoß für die PE-Ära...

Die Deutsche Bank ist übrigens auch mit im Boot. Ein von den Bloomberg-Autoren interviewter DB-Sprecher gab keinen Kommentar bzw. unterließ erbetene telefonische Rückrufe.

A.L.

Goldman, JPMorgan Saddled With Debt They Can't Sell (Update2)

By Caroline Salas and Miles Weiss

July 17 (Bloomberg) -- Goldman Sachs Group Inc., JPMorgan Chase & Co. and the rest of Wall Street are stuck with at least $11 billion of loans and bonds they can't readily sell.

The banks have had to dig into their own pockets to finance parts of at least five leveraged buyouts over the past month because of the worst bear market in high-yield debt in more than two years, data compiled by Bloomberg show.

Bankers, who just a few months ago boasted that demand for high-yield assets was so great that they would have no problem raising debt for a $100 billion LBO, are now paying for their overconfidence. The cost of tying up their own capital may curb earnings and stem the flood of LBOs, which generated a record $8.4 billion in fees during the first half of 2007, according to Brad Hintz, the former chief financial officer at New York-based Lehman Brothers Holdings Inc.

``The private equity firms, being very tough negotiators, are unlikely to let the banks off the hook,'' said Martin Fridson, chief executive officer of high-yield research firm FridsonVision LLC in New York. ``They'll say that's your problem and that's why we're paying you: To take risk.''

As the market began to turn sour last month, Goldman Sachs, Citigroup Inc., Lehman and Wachovia Corp. had to buy $725 million of bonds that Goodlettsville, Tennessee-based Dollar General Corp. was selling to finance Kohlberg Kravis Roberts & Co. purchase of the company for $6.9 billion. All of the securities firms are based in New York, except Wachovia, which is located in Charlotte, North Carolina.

Bonds Tumble

Those bonds are probably worth 94 cents on the dollar, or $43.5 million less than when they were sold on June 28, according to Justin Monteith, an analyst at high-yield research firm KDP Investment Advisors in Montpelier, Vermont. KKR completed the acquisition of Dollar General on July 9.

Bear Stearns Cos. strategists estimate that about $290 billion of deals still need to get funded, including those of Greenwood Village, Colorado-based credit-card processor First Data Corp. and energy company TXU Corp. of Dallas.

The question is ``how much yield are the brokerage firms going to have to eat,'' said Hintz... ``What they've committed to is not current trading rates in the market. If I have a problem it doesn't mean I can't place the problem, but it's going to cause a mark-to-market loss.''

Record Sales

Acquisitions by private equity firms such as New York's KKR and Blackstone Group LP helped push sales of high-yield bonds and loans worldwide up more than 70 percent during the first half of the year to a record $708 billion, according to data compiled by Bloomberg. High-yield, or junk, bonds are those rated below Baa3 by Moody's Investors Service and BBB- by Standard & Poor's.

The investment banking fees generated by LBOs in the first half amounted to almost two-thirds of the $12.8 billion paid by LBO firms to Wall Street in 2006, data compiled by Freeman & Co. and Thomson Financial show. In the race to win deals, the five largest U.S. investment banks more than tripled their lending commitments to non-investment grade borrowers during the past year to $174 billion, according to their regulatory filings.

KKR co-founder Henry Kravis in May called it the ``golden era'' of buyouts at a conference in Halifax, Nova Scotia. The extra yield investors demanded to own junk bonds rather than Treasuries shrank to a record low of 2.41 percentage points in June from the peak of more than 10 percentage points in 2002, according to index data from New York-based Merrill Lynch & Co. The spread has since widened to 3.07 percentage points.

[Der Spread zwischen Junkbonds und sicheren US-Staatsanleihen stieg vom Rekordtief von 2,41 % im Juni auf jetzt 3,07 Prozent, lag im Tief in 2002 aber bei 10 %. Dies zeigt, wieviel Verlustpotenzial noch in den Junkbonds steckt. - A.L.]

No Escape

For loans rated four or five levels below investment grade, the spread over the London interbank offered rate shrank to 2.12 percentage points in February from more than 4 percentage points in 2003. It has since widened to 2.72 percentage points.

Some bankers even speculated that $100 billion LBO was possible, a scenario that is now ``definitely'' off the table, said Stephen Antczak, high-yield strategist at UBS AG in Stamford, Connecticut. Wall Street's confidence in its ability to finance just about any deal led buyout firms to remove clauses in their purchase agreements that would allow them to back out if their banks couldn't come up with the financing.

Just three of the 40 biggest pending LBOs have an escape clause that lets the buyer back out if funding can't be arranged, said Mike Belin, U.S. head of equity derivatives strategy at Deutsche Bank AG in New York. A couple of years ago, a majority of deals included a financing contingency, Belin said, based on his research.

``If you were a credit officer or a risk manager who said `No' to virtually anything over the last few years you were wrong,'' Hintz said. ``So did they take it too far? Well, yeah. But that's part of any cycle. The issue is did they take it too far and is it going to hurt their earnings.''

Tribune Clause

Tribune Co.'s agreement to be bought by billionaire Sam Zell is one of the three acquisitions with an escape clause. Zell or Tribune can back out of the purchase if funding can't be obtained ``on the terms set forth in the financing commitments'' or on similar terms, according to regulatory filings.

Zell agreed to pay $25 million to Tribune, owner of the Los Angeles Times and Chicago Tribune, should the financing fall through. Tribune spokesman Gary Weitman said banks have ``fully committed'' to the deal.

The market for high-yield bonds and junk-rated, or leveraged loans began to crack in June as concerns that LBOs were becoming too risky coincided with a slump in the market for subprime mortgages that caused the near-collapse of two Bear Stearns hedge funds.

Junk Losses

Junk bonds lost 1.61 percent last month, the most since March 2005 when General Motors Corp. forecast its biggest quarterly loss since 1992 and the debt lost 2.73 percent, according to Merrill Lynch.

Investors refused to buy bonds to finance purchases of companies including Dollar General and ServiceMaster Co., forcing bankers to either buy the bonds themselves or extend a loan to make up for the securities that weren't sold.

In most deals, investment banks promise to provide loans to the buyer. They then seek other lenders to take pieces of the loans and find buyers for bonds. When buyers vanish, the banks must either buy the bonds themselves or provide a bridge loan to the borrower, tying up capital that would otherwise be used to finance more deals. The banks typically parcel out portions of bridge loans to reduce their risk.

Lending Commitments

Citigroup, the biggest U.S. bank, reported that its securities and banking division recorded an expense of $286 million in the first quarter to increase loan-loss reserves to account for higher commitments to leveraged transactions and an increase in the average length of loans.

Lehman reported on July 10 that its commitments for ``contingent acquisition facilities'' more than doubled in the quarter ended May 31 to $43.9 billion, exceeding its stock market capitalization of $39.1 billion. Lehman said its commitments contain ``flexible pricing features'' that allow it to charge more if market conditions deteriorate.

Goldman Sachs more than doubled its lending commitments to non-investment grade borrowers to $71.5 billion in the year ended May 31.

Citigroup spokeswoman Danielle Romero-Apsilos, Lehman spokeswoman Tasha Pelio and Goldman Sachs spokesman Michael Duvally, either declined to comment or didn't return phone calls.

ServiceMaster Bonds

JPMorgan failed to sell $1.15 billion of bonds for Memphis, Tennessee-based ServiceMaster on July 3. The banks provided ServiceMaster, the maker of TruGreen and Terminix lawn-care products, with a bridge loan to make up for the failed bond sale. ServiceMaster is being bought by private equity firm Clayton Dubilier & Rice Inc. for $4.7 billion.

KKR and New York-based Clayton Dubilier this month completed their $7.1 billion purchase of Columbia, Maryland-based US Foodservice, a unit of Dutch supermarket company Royal Ahold NV, even though junk bond investors refused to buy $1.55 billion of bonds and $3.37 billion of loans to finance the deal, according to estimates from New York-based Bear Stearns.

Deutsche Bank led the bond offering, which included $1 billion of ``toggle'' bonds that would have allowed US Foodservice to pay interest in either cash or additional debt. KKR and Clayton Dubilier relied on loans to complete the deal, according to S&P's Leveraged Commentary and Data unit.

`Beyond Our Risk'

``Many of these things are beyond our risk desires,'' said Bruce Monrad, who manages $1.5 billion of high-yield bonds at Northeast Investment Management Inc. in Boston.

JPMorgan spokesman Adam Castellani, Deutsche bank spokesman Scott Helfman and Morgan Stanley spokeswoman Jennifer Sala either declined to comment or didn't return calls. All the banks are based in New York, except Deutsche Bank, which is in Frankfurt.

Banks can always sell the debt if demand increases. Meanwhile, they may have to report a loss from the decline in value of their holdings, a process known as marking to market.

Banks could also lose money should they have to offer discounts on loans in order to syndicate the deals, said Tanya Azarchs, a banking industry analyst at New York-based S&P.

``I don't think it's going to cause banks to fail or even lead to downgrades,'' Azarchs said. ``But I do think there will be a little indigestion and lower earnings.''

The biggest concern is ``hung deals,'' where a lender is left holding a large loan to a single borrower, said Azarchs. ``Those traditionally in all the prior credit cycles have caused the greatest amount of grief for the large syndicating banks,'' Azarchs said.

In 1989, First Boston Corp., now part of Credit Suisse, made a bridge loan for a buyout of Ohio Mattress Co., the predecessor to Sealy Corp. The junk bond market collapsed before First Boston could refinance the loan, and the securities firm ended up owning a big stake in the bedding manufacturer.

The deal became known as ``Burning Bed.''

TXU, First Data

``The thing about this business is memories are two seconds long,'' said James Schell, a private equity attorney in the New York office of Skadden, Arps, Slate, Meagher & Flom LLP.

Banks led by Citigroup committed to extend $37.2 billion in credit to fund the purchase of TXU by a group that included KKR, Fort Worth, Texas-based TPG Inc. and Goldman Sachs's private equity group. The financing will comprise $25.9 billion of term loans and $11.3 billion in an unsecured bridge loan.

Credit Suisse, based in Zurich, is leading banks in the U.S. that have agreed to provide KKR with $16 billion of loans for its $26.1 billion takeover of First Data. The plans include an $8 billion bond sale, which is scheduled for August or September, according to a Banc of America Securities LLC research report.

[Ob Credit Suisse da wohl auch auf einer großen Tranche sitzen bleibt? - A.L.]

For firms such as KKR or Blackstone, both based in New York, the tighter credit environment may make their acquisitions less profitable and even change the way they go after future targets. Mark Semer, a spokesman for KKR, declined to comment.

``The underwriters are going to be forced to provide bridge loans and it's getting pretty ugly, but Wall Street deserves to get smacked around a little,'' said William Featherston, managing director in high-yield at J. Giordano Securities LLC in Stamford, Connecticut. ``It's been easy for so long.''

To contact the reporters on this story: Caroline Salas in New York at csalas1@bloomberg.net ; Miles Weiss in Washington at mweiss@bloomberg.net

Last Updated: July 17, 2007 11:55 EDT

IM FREIEN FALL: ABX-Junkbond-Index für Subprime-Hypothekenkredite, dessen Absturz auch die beiden Bear Stearns-Hedgefonds in die Krise schickte.

|

Angehängte Grafik:

screen_00123.jpg (verkleinert auf 96%)

|

2 |

3 |

4

|

2 |

3 |

4

Thread abonnieren

Thread abonnieren